Avoid 'We Buy Any House' Scams & Find Out Which Cash Home Buying Companies are Safe-to-Use

"TheAdvisory is one those secret sources I keep close to my chest."

How the #1 Fast Cash Home Buyer Scam Works

Over promise on their initial offer

Shady cash buying companies will make an unrealistic high offer and promise to get the money in your hands in a matter of days pending an official valuation.

Use delay and stall tactics

Using every delay and stall tactic in the book, these companies will drag out the process for months.

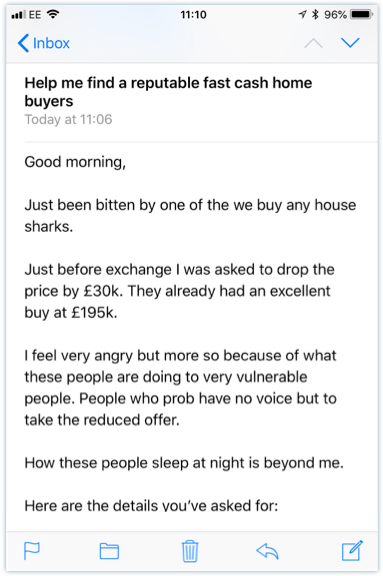

Drop price at 11th hour - when you have no choice but to accept

At the last possible moment, these companies will cut you back savagely when you’re out of time and unable to do anything other than to accept.

ALSO: Lock you into an 'Option Contract'

Some companies will also push you to sign paperwork (hoping you don't read the fine print) that prevents you from selling to anyone else.

a cash buying company tried to drop the price at the 11th hour

It gets worse:

'We Buy Any House' companies often don't have the cash to buy your home

We Buy Any House Fast Without Estate Agents

Sell Your Home At Top Market Value, Fast Evaliation For Selling

Our expert estate agents offer stress-free property sales, even in complex situations like divorce, providing fair valuations and quick cash transactions, ensuring you get the best price without the hassle of a traditional auction or estate agency trading. With “We Buy Any Home,” you can avoid the uncertainties of UK house prices and scammers; our regulated company provides a solid finance solution, offering a sale and rent back scheme with a clear timeframe, managed by professional solicitors. Whether you’re facing repossession or simply need a swift sale, our experienced team conducts a thorough property appraisal and valuation, enabling homeowners to sell their properties quickly and for cash, bypassing the lengthy conveyancing process. As a leading company in the UK, we take pride in our transparent trading practices, accredited by regulatory bodies; “We Buy Any Home” gives you a competitive property valuation based on current market data from sources like Zoopla, without any scam risks. Tailored for buyers and sellers in the UK, our estate agency ensures that every property sale is managed by skilled solicitors, providing you with an accurate property appraisal and quick finance, even if you’re not present in your house, with no additional fees for homeowners.We Buy Any House – Expert Home Buyers

Buying Homes Through Buying companies, Auction or Estate Agents

If you’ve inherited a property and need to sell your house fast, our agency offers a better solution than traditional selling methods; as expert house buyers, we buy any house for money, bypassing the auction process and providing you with a quick, firm offer without the delays of dealing with an estate agent. When facing repossession, don’t settle for the uncertainty of auction; our buying company specializes in quick transactions, allowing you to sell your home promptly and move on with your life, with our expert team ready to buy houses in any condition, offering you a fair price and saving you from the hassle of selling your house through traditional methods. Unlike traditional buying companies, our agency makes competitive offers to buy your house directly, ensuring a quick sale without the worry of your house being on the market for months; we buy properties outright, giving you the peace of mind and the money you need, especially when selling an inherited home or avoiding repossession.We Buy Any Home – The Fastest Way To Sell Your Home

Looking to sell your home? Our team specializes in buying homes and we’re ready to help you find you sell your house house fast. At our core, we buy any house, regardless of condition, offering a stress-free house buying process for every client. You’re guaranteed that we will buy any house, providing you with the best market offers and a quick sale.- We buy houses swiftly and with ease.

- Buying properties is our expertise, and we ensure a fair deal every time.

- Whether it’s a modern apartment or a traditional home, we buy any property.

- Looking for a hassle-free way to sell? We buy any house, offering competitive prices and quick closings.

Buying Homes

We Buy Any House

We Buy Homes

House Buying and Selling Strategies

House buying, offering to buy any home at competitive house prices, ensuring buyers get value through accurate property valuation. Buying homes quickly, with a focus on providing fair valuations and swift conveyancing for every buyer.

Companies that buy houses for cash are NOT regulated by any government body

Anyone that claims differently is misleading you – no one is effectively policing this space.

That’s why shady companies are able to routinely take advantage of vulnerable people trying to cope with high-stress situations.

"The [Quick Sale industry] is yet another area of the property sector where there is no formal regulatory framework.

Whilst I note that the OFT is pursuing a self-regulatory approach, the only way of realistically ensuring all such firms provide consistent service is through legislation."

You can sell your home fast to a 'We Buy Any House' company without getting ripped off - we'll show you how

Protect yourself with our insider knowledge of the industry and safely navigate these treacherous ‘Quick Sale’ waters.

Keep reading to learn how to spot scammers and identify reliable and trustworthy cash buyers…

Meet Gavin Brazg

‘Quick Sale’ Industry Since 2005

On the face of things, all ‘Quick Sale’ companies look and smell the same.

So how do you tell who the reliable and trustworthy guys are?

I’ve been asked this question by house sellers since 2005 and have monitored this sector ever since in order to provide answers.

Hi,

I’m Gavin Brazg, founder of TheAdvisory, the UK’s oldest advice and support resource for home sellers.

I’m not an estate agent but I am a serial house seller that buys and sells over 150 properties a year.

I started TheAdvisory after accidentally stumbling upon a huge appetite online (from the public) for answers to a variety of house selling questions – including problems and issues with cash house buying companies.

Coming from a land development and house building background, these were all things I knew inside out, so I wrote some articles to help answer peoples’ questions and stuck them on the web…

Hey presto!.. TheAdvisory was born.

What I didn’t foresee was how big TheAdvisory would get.

To date, TheAdvisory has been visited by over 5 million UK house sellers, and I’ve personally advised over 20,000 property owners on how best to safely sell quickly for cash.

Over this time I’ve become more than a little addicted to helping protect the public from the unethical practices found in the property industry.

I’ve also had to grow a team to help run the site. All members are also serial house sellers and veterans of the UK residential property industry.

Most started within estate agency and then moved into the corporate property sector, specialising in asset management and developer part exchange services.

As a collective we’ve been trusted to project manage over 6,000 residential property sales for the likes of HSBC Bank, Barratt Homes, Taylor Wimpey, Investec, Lloyds Bank, McCarthy and Stone, Persimmon Homes, GE Money and Aviva.

Here’s what gets us up in the morning:

- We love helping protect people from scams and unethical industry practices.

- We love sharing our insider knowledge of how to get better house selling results.

- We love having the opportunity to make a positive impact in peoples’ lives.

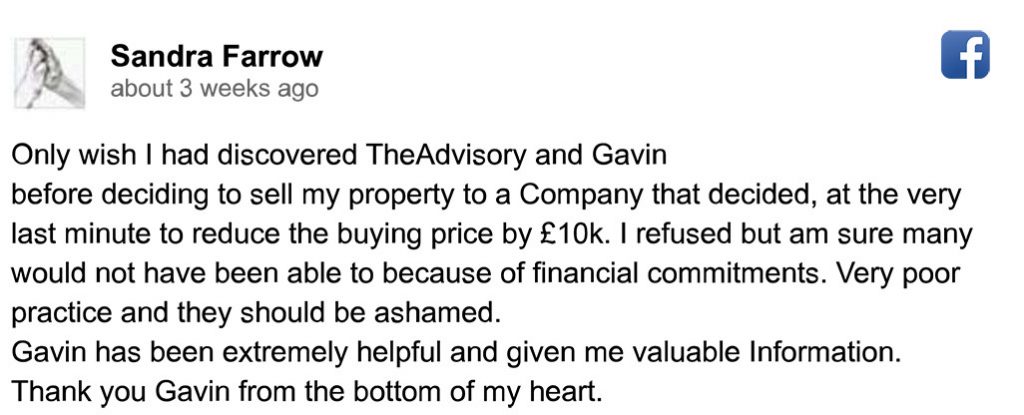

“Genuine solid & honest advice from Gavin..."

How to Spot 'We Buy Any House' Scammers vs. Trustworthy Companies

9 rules to protect yourself from scams

WALK AWAY IMMEDIATELY IF A COMPANY:

Asks for an upfront payment of any kind.

Asks for any cancellation or withdraw fee within their paperwork.

Asks you to sign a ‘lock-in contract’, ‘option agreement’ or ‘RX1’ form.

Claims to provide a guaranteed sale for close to 100% of market value.

Claims they (or the industry) are ‘regulated’ by a government body.

Claims they can sell your house to investors for +90% of market value.

Wants to put a 'restriction' against the title of your property with HM Land Registry.

Does not have a clearly visible Company Registration Number on their website.

Cannot provide ‘proof of cash funds’ upon your request.

Get matched with reliable and trustworthy quick property buyers

We believe all ‘Quick Sale’ companies should be safe and have high ethical standards – sadly this is not the case.

That’s why we created the ADVISORY APPROVED program, a system of accreditation to highlight reliable and trustworthy companies.

You get fast access to companies that won’t mess you around or reduce their offer by £10,000’s at the last minute.

Rigorous vetting

All ADVISORY APPROVED companies have passed a rigorous 15-point vetting process.

It’s tough. 97% of companies fail.

Those that do pass are guaranteed to be reliable, trustworthy and 100% risk-free to get offers from.

How we monitor the ‘Quick House Sale‘ sector to help you find the reliable & trustworthy companies

We regularly mystery shop cash house buying companies that operate in England, Wales and Scotland.

We collect stories from sellers using these companies – this keeps our finger on the pulse of who is (and isn't) providing a fair service.

We verify that companies actually have the cash readily available to buy your home.

Trusted advice since 2005

The ADVISORY APPROVED program has been trusted by over 20,000 home sellers since 2005

Our Promise to You...

All ADVISORY APPROVED companies pass the following screening criteria:

- Genuine cash buyers with verified cash on hand

- Won't drop offer at the last minute

- Fair valuation of your property

- Can have cash in your hands in 7 - 28 days

- Will buy property in any condition in your location

Get Your FREE Recommendations for Reputable Cash Buying Companies

Get matched with home buying companies that are safe, easy to work with, and actually have the cash on hand to buy your home quickly.

How it works:

- Answer 6 quick questions about a property.

- You’ll get a FREE personalised list of ADVISORY APPROVED companies most likely to pay above average prices.

As recommended by:

Wary about scams?

You should be!

Google Review

Dear Gavin,

Thank you so much for expressing your sympathy and for your advice which I’ve just read through and taken note of. I spoke to your recommended companies earlier today after trying to sell my home through an NAPB member that turned out to be scammers.

Your recommended companies were in contrast very upfront and honest. I thought I’d done my research as best I could and decided to use this other company back in May.

I was shocked to see my home advertised on Zoopla when I was assured that they buy houses.

I am still waiting for one of their ‘investors’ to buy the bungalow, even though I asked specifically if they actually have the funds to buy property and was assured that they do.

I should have asked for proof of this, but didn’t. I only found your site tonight and wish I’d found it before because I tried to find as much information as possible about which companies to avoid.

Thank you so very much for helping me avoid worse trouble, because I contacted two more house buyers before finding your page.

Needless to say, I will not be speaking to them when they contact me. I cannot believe people can be so callous when they have no idea about an individual’s situation.

Once again, thanks and please carry on what you’re doing. I often think about older people without a support network and how horrible it must be for them to be scammed in any way.

What to Expect Selling to

We Buy Any House Companies

When should I consider selling to a cash property buying company?

You should only consider using the services of a specialist buying company if:

“Your need to move is GREATER than your need to sell for the best possible price“

Then (and only then) should you explore this method of sale!

How quickly can genuine companies buy my house for cash?

A reputable and professional cash homebuyer will be able to buy your house and put cash in your bank account within 7 – 28 days.

Many claim they can do this in 24 hrs but in reality, there are only one or two specialists that have the resources to make this happen.

If you have the misfortune to end up dealing with a less than a genuine buyer, expect the process to be drawn out for months as they try to secure finance or find you a buyer.

How much with a we buy any home company offer for my house?

We’ve observed thousands of quick sales and 99.99% of them have gone through at 75%-82% of a conservative estimate of open market value.

The shady companies will claim they pay ‘up to’ 85% or 90% of your home’s open market value.

Some even say they pay ‘up to’ 100%.

The words ‘up to’ are deliberately chosen to mislead.

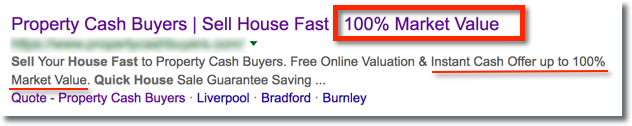

Be wary of adverts like this:

If anyone makes a claim that sounds too good to be true…it is!

In fact, any offer above 82% should be treated with a certain amount of suspicion.

Anyone claiming to pay 85%, 90%, 95%, 100% is NOT offering a ‘guaranteed‘ cash purchase of your property.

They are offering to ‘sell’ your property (not to ‘buy’ it).

How do I get a conservative estimate for how much my property is worth?

The easiest way is to talk to a couple of local estate agents and ask them:

“If I give you 6 weeks to sell my house, what price could you definitely secure a buyer at?”

The question above encourages agents to give you a more considered estimate of open market value (as opposed to the usual deliberate overvaluation used to impress and win new clients).

Are there any other costs to expect selling to a reputable house buying company?

The reputable firms we’ve identified in the market do not charge any fees, and most also pay your legal fees (although that is deducted from their offer price).

But beware…

There are a number of ‘we buy any home type companies’ that will make you a verbal offer, but then insist you pay an inflated price for their surveyor’s valuation (anywhere from £200 – £600) before they’ll put an offer in writing.

They will usually phrase it as a ‘refundable payment for valuation’ which sounds fine – it’s ‘refundable’ after all.

However, because the money is only refunded if you accept their offer, this system is wide open to abuse.

Companies can pocket a quick £200 by making you a strong verbal offer and then lowering it after you’ve paid for the valuation.

Do that a couple of times a day and you have a business that doesn’t even need to buy any property to be profitable.

Steer clear of any home buying service that asks for an upfront payment of any kind.

Also, steer clear of any home buying service asking for any withdrawal or cancellation fees of any kind (even if they are waivered should the buyer reduce their price).

Can I still sell to a property buying company if I'm on the market with an estate agent?

Yes, but…

Whether or not you’ll have to pay your estate agent a fee will depend on what type of estate agency contract you’ve signed.

Check your estate agency contract to see if it’s either a SOLE AGENCY agreement or a SOLE SELLING RIGHTS agreement (your contract should be clearly labelled).

If it’s SOLE SELLING RIGHTS then I’m afraid your agent will be within their rights to claim a fee.

It it’s SOLE AGENCY then your estate agent will not be able to claim a fee.

Should I try to sell via auction before approaching cash house buyers?

If you need a guaranteed sale, think very carefully before you choose auction over a reputable fast house buying company.

You only get one chance to get it right – here’s why:

- The big problem with auctions (especially online auctions) is that your property is publicly advertised with a low guide price on Zoopla & Rightmove.

- If your property fails to sell, house buying companies will use your low guide price as a starting point for calculating their offers.

Bottom Line: Cash offers from house buying companies get reduced by £1,000’s after a failed auction attempt.

Get Your FREE Recommendations for Reputable We Buy Any House Companies

Get matched with home buying companies that are safe, easy to work with, and actually have the cash on hand to buy your home quickly.

How it works:

- Answer 6 quick questions about a property.

- You’ll get a FREE personalised list of ADVISORY APPROVED companies most likely to pay above average prices.

As recommended by:

FAQs

✅Are there any legitimate cash property buying companies in the UK?

Yes (a few).

There are only a handful of genuine cash buying companies in the UK that have the funds to purchase your property, and won't drop the price at the last minute.

If you need the services of one of these companies, the main problem you face is knowing how to identify the ‘good guys’ from the scammers.

Through TheAdvisory you can get (for free) a list of vetted house buying companies that are genuine cash buyers with a long track record of reliability and honesty.

✅Is this really a free service?

Yes.

This service is 100% free and we will do everything we can to always keep it that way.

✅What are the top 10 reasons people contact cash house buying companies?

1. Struggling to sell with Estate Agents.

2. Inherited property to sell.

3. Buying another property.

4. Relocating (in UK).

5. Moving to be near family, or to be a carer.

6. Divorce/separation.

7. Empty property they need to sell.

8. Financial difficulty.

9. Facing repossession.

10. Emigrating.

✅Is TheAdvisory unbiased?

Absolutely not!

Sadly we know (and have seen) too much to be unbiased about house buying companies.

We hold very strong opinions about who the good guys are in this industry, and who the bad guys are.

Although we will never publicly ‘name and shame’ the bad guys (or talk negatively about any individual company for that matter), we will go out of our way to help promote the good guys.

We make no apology for this.

Our priority is you and making sure you have easy access to ‘safe-to-use’ companies that we are able to endorse with 100% confidence.

That’s why with TheAdvisory you get strong opinions, rigorous research and the same advice we’d give family and friends.

✅Are cash house buying companies regulated?

No.

This industry is not regulated and so you should be very suspicious of anyone that claims to be.

Have no fear, if you follow our 8 golden rules, you'll protect yourself from all the most common scams.

Plus, if you want a second opinion on anything, we're here to help and always happy to share our expertise freely.

✅Why should I get an offer from an ADVISORY APPROVED buyer?

If you are thinking of selling your property to a company that will pay cash, there are many marketing scams, and unreliable (or fake) cash home buying companies you want to avoid.

Because it’s such a minefield, we set up this free service to enable you to quickly (and safely) evaluate whether selling to a cash house buying company is right for you.

All ADVISORY APPROVED companies have passed our rigorous 15-point screening process meaning you can relax safe in the knowledge they’re genuine, reliable, and 100% risk-free to get offers from.

✅Does TheAdvisory get a fee?

To keep this service free for you, we’ve recently started to explore this option.

Most (but not all) ADVISORY APPROVED companies have started to pay us a small fee when you request an offer from them.

These fees help us:

- Keep the lights on so we can continue to research and vet cash house buying companies.

- Publish and promote insider guides to help house sellers avoid costly scams.

IMPORTANT: This arrangement doesn’t cost you a penny.

In fact, it gets you a better offer.

That’s because the fee these companies pay us is much less than their standard marketing costs (i.e. TV, press & online advertising) to reach potential clients like you.

They pass on the savings to you in the form of a better offer.

Everybody wins!

✅Does getting a fee influence who we recommend?

No.

We are regularly contacted by companies offering to pay us for our endorsement.

However, companies cannot buy ADVISORY APPROVED status – they have to be invited.

Companies are only invited if they’ve passed our 15-point vetting process and we’d be willing to recommend them to family and friends.

What’s more, ADVISORY APPROVED companies are continually monitored and must maintain standards or lose our endorsement.

✅How is my personal information protected?

All connections to and from our website are encrypted using Secure Socket Layer (SSL) technology.

Read our privacy policy for our privacy and security practices.

✅Can I get your feedback on an offer I have received?

Yes. Email Gavin Brazg (info@theadvisory.co.uk) with as many details as possible. You will usually get a response within 48 hours.

✅What is your 15 point vetting process?

Companies recommended by TheAdvisory meet the following criteria:

- Been actively trading for at least 5 years.

- Do not have a reputation for reducing their offers at the last minute.

- Do not charge valuation fees or withdraw fees.

- Provide 100% risk-free offers (i.e. No fees, no obligation, no paperwork to sign and do not tie you in).

- Do not ask you to sign a ‘lock in’ contract (which effectively traps you for months), or ‘tie-in’ document (which discourages you from speaking to other companies), or try to lodge any charges against your property with HM Land Registry.

- Purchased more than 250 properties with and have a minimum of one-hundred 4/5 star verified reviews on independent 3rd party platforms (e.g. Google, Facebook, TrustPilot).

- Will directly purchase your property (depressing side note: Many of the ‘Quick Sale’ companies you’ll find on the web are ‘fake’ cash house buyers – they don’t have any money, they are just looking to sell your personal details).

- Not reliant on 3rd party funding / bridging finance. (i.e. They have access to +£5m ready cash making their house buying service more secure and more flexible than companies reliant on 3rd party funding / bridging finance).

- Able to purchase freehold property in as little as 48 hours (if needed).

- Able to offer quick exchange with a delayed completion or license to occupy (if needed).

- Able to buy unmortgageable property.

- Do not claim to be able to sell your property to a database of investors for +90% of market value.

- Do not claim to be ‘regulated’ by a government body (the industry is not regulated).

- Consistently generate positive feedback from TheAdvisory visitors.

- Have a positive reputation amongst other industry insiders for ethical and honest business practices.

The 15 Point Vetting Process

Companies recommended by TheAdvisory meet the following criteria:

- Been actively trading for at least 5 years.

- Do not have a reputation for reducing their offers at the last minute.

- Do not charge valuation fees or withdraw fees.

- Provide 100% risk-free offers (i.e. No fees and no obligation).

- Do not ask you to sign a ‘lock in’ contract (which effectively traps you for months), or ‘tie-in’ document (which discourages you from speaking to other companies), or try to lodge any charges against your property with HM Land Registry.

- Purchased more than 250 properties, and have a minimum of one-hundred 4/5 star verified reviews on independent 3rd party platforms (e.g. Google, Feefo, TrustPilot, etc).

- Will directly purchase your property (depressing side note: Many of the ‘Quick Sale’ companies you’ll find on the web are ‘fake’ cash house buyers – they don’t have any money, they are just looking to sell your personal details).

- Not reliant on 3rd party funding / bridging finance. (i.e. They have access to +£5m ready cash making their house buying service more secure and more flexible than companies reliant on 3rd party funding / bridging finance).

- Able to purchase freehold property in as little as 48 hours (if needed).

- Able to offer quick exchange with a delayed completion or license to occupy (if needed).

- Able to buy unmortgageable property.

- Do not falsely guarantee a sale for +90% of market value to a database of investors.

- Do not claim to be ‘regulated’ by a government body (the industry is not regulated).

- Consistently generate positive feedback from TheAdvisory visitors.

- Have a positive reputation amongst other industry insiders for ethical and honest business practices.