Definitive Guide:

Selling Your Home vs. Renting It Out

Find out what's right for you!

2024 update

Keep reading to discover…

- What it’s really like to become a landlord

- How to avoid being caught out by mortgage or tax issues

- How to make smarter decisions

- And lots more…

Table of Contents

-

Key takeaways

-

Should I sell my house or rent it out?

-

When does renting your home make sense?

-

What do you think will happen to house prices?

-

Becoming a landlord is hard work

-

Can you afford to own & maintain two properties?

-

Will renting your old home be profitable?

-

Mortgage issues when renting out your home

-

Income tax issues

-

Capital Gains Tax (CGT) issues

-

How to rent out your house (step-by-step)

-

What is ‘Let to Buy’?

-

Common questions

-

Summary

-

Related guides

Key takeaways

- Becoming a landlord can impact the amount of tax you pay and benefits you receive.

- It’s unlikely you can let your own home in its current condition; there are 400 rules and regulations to abide by to let legally and safely, even to friends and family.

- Seeking professional advice is essential before you decide to let a home you own and buy another.

Should I sell my house or rent it out?

Sometimes you’re left with no choice:

- It’s estimated that up to 30% of landlords are considered ‘accidental’ i.e. letting their own home because they couldn’t sell or are working away temporarily.

- Accidental landlords tend to let because they have to, rather than just to make money.

- For some it has been a great decision, they have managed to make money and even build a buy to let portfolio off the back of letting their first home.

- However for others it has not worked out at all.

- Some have seen a home they once loved ruined through damage while others have not received rent for months at a time and ended up being owed thousands or tens of thousands of pounds.

So, as always with property, there are winners and losers.

Before you sell or rent your existing home and buy another, it is vital to take expert financial and tax advice to understand the pros & cons of each route.

Renting it (pros & cons)

Pros

- Potentially help you move home if you’re only moving away temporarily or can’t sell the property.

- The hassle of renting can be outsourced to a quality agent – one who is a member of NALS, ARLA or UK ALA.

- A decent tenant will pay rent on time and take care of your property.

- You can make an income and secure capital growth from retaining the existing property and letting it.

Cons

- You may need to invest money ensuring the property meets the legal requirements e.g. fit a new fuse box or put in a new boiler.

- Tenants can cause damage to your home (even setting up cannabis farms), which may/may not be covered by your landlord insurance.

- Taking on additional debt may result in losing both homes if prices fall and/or you default on mortgages.

- Keeping up with new and the existing 400+ rules and regulations to let a home is difficult and if you don’t, you can be fined up to £30,000 for non-compliance.

- If the tenant stops paying the rent, you can lose income and end up having to pay out a lot of costs keeping the property going. This can also happen when the property doesn’t let (referred to as ‘void periods’).

- Renting a property can be expensive to maintain and can cost more than the rent you receive.

- Taxation on ‘second homes’ including buy to let can be much higher than investing money in other ways.

Selling it (pros & cons)

Pros

- You can spend more on your next home.

- Any additional money you spend on a new home means when you sell, the gain is free of Capital Gains Tax.

- It allows you to move on with your new life.

- It allows you to release equity to spend or reinvest in less risky investments.

- Less hassle: no unexpected repair bills, tenant damage or voids.

- Not putting all your eggs in ‘one basket’ relying on one property to deliver a return.

Cons

- You may be selling off a lucrative asset that grows substantially in value.

- If the property is in negative equity you may have to use spare cash to pay off and redeem the mortgage.

- The property may earn a good income and contribute to your pension in the future.

- It may take time to sell, putting off your ability to move to a new area/property.

- Emotionally it can be difficult to part with a family home.

See: How to sell your house (like a ‘pro’)

Or, if you need to sell fast, discover the best way to sell your home quickly and avoid scams…

See: AVOID SCAMS

When does renting your home make sense?

Before you assume it’s a good idea to let the property out, it is worth analysing the implications in the future, at least by 5 or even 10 years.

Here are the ten steps you need to take to make sure you understand the implications of selling versus renting from a financial perspective:

- Find out what the rental market is like for your existing home, not just now but in the future.

- Forecast what your existing home would be worth in the future – has it already benefited from huge capital growth over the last few years and these rises are now slowing or is there a reason for a potential big uplift, such as new transportation?

- Understand the true costs of renting a property, including what upgrades are required to let legally to tenants – These may cost several thousands of pounds.

- Work out if you can afford the new property you want and cover the costs of the existing property, especially if you haven’t any rent coming in.

- Ensure you understand the tax implications of earning rent and securing capital growth from the property. Will you lose any benefits such as child benefit if the rental income takes your earnings over £50,000?

- Compare the returns (net of tax) of renting a property versus investing the same amount of equity in other investments, such as financial instruments / markets.

- Check if your existing lender on your first home would allow you to retain the current mortgage terms (and rates), how long for and at what cost (if any).

- Understand the implications and how you can insure against the risks of letting. These include: voids, tenant damage, loss of rent, eviction costs, job loss and sickness, all of which can make it difficult to let and own a home at the same time.

- Find out if you need to be licensed or registered as a landlord (you do in Northern Ireland, Wales, Scotland) or if the property requires a license from the local authority to be let. Know the costs and how you will abide by and keep up with the national and local laws.

- Work out how long you intend to keep the rental property for and if you plan to buy more properties, check if your lender allows this and if they need a formal business plan.

Scenario #1 – Should i sell my house and rent to get out of debt?

- Before you decide to do anything, if you’re in debt, then it is worth seeking specialist debt advice from an independent, ideally charitable organisation (sell the list below).

- There are lots of companies online that claim to help solve debt problems but beware because some companies are not terribly honest or upfront about their charges or how they get paid.

- Once you have sought independent, expert advice, if appropriate, it is wise to talk to your lender directly if you have a mortgage on your property (especially if you’re already behind with mortgage payments).

- If you are nervous about doing this, a mortgage broker may offer to help to do this on your behalf, particularly if they secured the mortgage for you in the first place, or the debt charity may help.

- It may be you could extend the length of time of the mortgage, for example from 25 to 35 years or if you have already paid off some of your mortgage, you may be able to borrow more, clear your debts and even retain your home.

- If the professional advice is to sell your home, then it may be possible to trade down to a smaller property or to a cheaper area and still own a home, or you may be able to use a government-subsidised scheme such as Help to Buy or Shared Ownership to buy another property.

Alternatively it may make sense to rent…

- If you rent, find letting agents first who are members of ARLA, NALS or UKALA so properties will be let legally and understand letting legals – specifically the rights and responsibilities of landlords and tenants.

- If you rent directly from the landlord, check they know how to let legally, for example are a member of a landlord association or accreditation scheme.

Some easy checks to make to see if the landlord or agent acts legally is to ask them:

- Which government scheme your deposit will be held in (if an assured shorthold tenancy agreement)?

- If you can see the Energy Performance Certificate?

- What Right to Rent checks they make?

- If the property has a boiler & a gas safety certificate?

All of the above are required by law, as is being given the ‘how to rent guide’, a government publication to educate tenants.

The risks of rushing in!

If you don’t check or learn about letting legally, you could end up renting from an accidental landlord letting their home and not abiding by the law; someone that is a rogue and treats you badly; or someone that evicts you at a moment’s notice, both of which are illegal.

Where to get free debt advice?

When in debt, this can be a very scary time, especially if the debt is caused by another stressful life event such as illness, loss of work, someone dying or divorce.

As such it is sensible to seek independent advice as soon as possible from one of the recognised debt charities below:

- Citizen’s Advice – http://www.citizensadvice.org.uk/

- StepChange – http://www.stepchange.org/

- The Money Charity – http://themoneycharity.org.uk/

- Debt Advice Foundation – http://www.debtadvicefoundation.org/

- Debt Support Trust – http://www.debtsupporttrust.org.uk/

- National Debtline – https://www.nationaldebtline.org

Scenario #2 – Buying with partner should we sell both our old homes?

- This very much depends on whether you have already been together for some time or not.

- If you are moving in together for the first time, it might be worth holding on to both homes and living in one to check it is the right thing for both of you.

- If things work out, you can consider selling one or both homes and if they don’t, both of you can go back to living the lives you did previously without too much upheaval.

- Whether you decide to sell or rent out one of the properties, you will need to draw up an agreement on who pays what bills and what happens if you split.

- If you find this difficult to do, seek advice from an independent financial advisor or legal company, without an agreement, a split is going to be much harder than it need be.

Once you are sure that living together works for both of you, then you can consider what you want to do moving forward:

- Will you be happy living in one of the existing properties you own?

- Do you want to sell both properties and move to a new property to set up home afresh?

- Is it possible to rent out one or both properties and still secure a new home to live in?

- Which property would offer the best home and which the best rental potential?

- What agreement do you need to ensure if you split or if something happened to either of you, you and any of your children still benefit from what you brought to the relationship from a financial perspective, especially if you end up remarrying.

Scenario #3 – We’re on the market but the house isn’t selling

Before you decide to let your existing property, it is essential to diagnose why the property isn’t selling:

- It may be the price is too high or there is an easy problem to solve such as sorting out bad wiring, off putting cracks in walls or just updating the property with a lick of paint.

- It may be a simple reason why your property isn’t selling and if you can fix it, it is possible to sell and move on.

- Alternatively it may be that your property can’t be sold easily on the open market and needs to be sold to a professional cash house buying company that can provide you with a certain and speedy sale.

- You won’t get anywhere close to full market value but it may at least allow you to move on at speed if required.

- See: How to find reputable ‘we buy any home’ type companies

- However, if you cannot secure a buyer because the market is relatively quiet, but you need to move for a new job or to be closer to family and friends within a specific timeframe, then it may be worth investigating letting your home instead of selling it and waiting for the market to pick up or seeing what returns lettings give.

Is the property suitable for renting?

- The first thing you will need to do is to check with your lender whether it is possible to let the property – especially if you want to retain an existing mortgage on it.

- Some lenders will allow you to switch to letting, while others may require you to secure a new mortgage and redeem theirs, all of which costs money.

- Secondly you need to know whether your property will attract tenants and what they will pay.

- Not all properties in all areas are suitable for letting. For example, if you are thinking of letting to students they will expect to be within a short distance of the university or higher education.

- If renting to a family with children, it is likely the school catchment area is one of the most important considerations and if you are in the right one, it might not work.

Minimum rental terms

- Unfortunately you cannot just let a property to someone because you are moving on.

- You will need to let the property typically for a minimum period of six months and may have to spend thousands of pounds upgrading electrics and gas to let legally and safely – and that’s even before you secure a tenant.

Your legal obligations

- You can’t just ‘test the market’ – Some things need to be in place before tenants move in, such as an EPC. And you will need to make sure the property meets current legal requirements.

- For example, to let a property from April 2018, if an EPC on a property is either F or G rated (and not Listed) then you will not be able to let the property.

- If there is damp and mould, poor locks, broken windows or fences then the property isn’t legally safe to let and could incur fines of up to £30,000 for each mistake you make.

- This is the case even if you are letting the home to friends and family!

The bottom line

- Overall, there are 400+ rules and regulations you need to know before you let.

- An easier way to let legally is to let through an agent that is a member of ARLA, NALS or UK ALA.

- This will also mean they have client money protection should someone walk off with your rental income or the company goes bust.

- Letting property is extremely complex and before you decide to do it, you need to understand it is an investment and a large one at that.

- It has different tax implications for different people, which can mean you lose benefits or end up in a higher tax bracket.

- This may mean you end up potentially worse off than if you had sold the property.

The advice is clear:

Never let a property until you are fully aware of the tax and legal implications and this applies even if you let to family or friends.

Scenario #4 – We’re not 100% sure we really want to move

- If you are not sure whether you’d like to move or not, renting out your existing home and renting in new area might help you make your mind up.

- You may even just want to try living in a different type of home which would be a big change, such as moving from a new build to a listed property or a large house when thinking of downsizing to a small flat.

- Doing this is especially helpful if you are considering moving to a new area. For example you may live in a city but think the country is where you would like to be.

- Before making such a drastic move though, it could be worth doing it temporarily to check it’s the right thing for you, rather than diving in.

- To find out if this is a possible, first check your property can be legally and safely let and that the costs will be covered by rental income and check how much it will cost you to rent in the new area.

- Secondly, you will have to let your home for a minimum of six months. After this time, with the correct notices either you or the tenant can move back in/out. After this fixed period, both you and the tenant tend to have to give two months notice unless a new six-month contract is signed.

- As long as you let the property carefully you should be able to secure possession back when you wish, either to move back in or to sell the property as you are happy your new life is what you actually want.

- Alternatively, rather than renting both properties you could instead take a few weeks off work and stay in the new area or property type you are thinking about buying.

- Even a few weeks can give you enough time to check work commutes, the time it takes to visit to friends and family as well as places to shop, eat out and enjoy leisure time.

A word of warning

- Be careful of the timing to check a new area to live in if it is affected by tourism.

- Some places can shift from being almost deserted to being overrun with people and cars, especially if a seaside resort like Padstow or areas of outstanding natural beauty.

Scenario #5 – Worried that paying off our mortgage will be expensive?

- For some people the idea of keeping a property to let is because cashing in the mortgage on sale may trigger a redemption charge, which may cost thousands of pounds or more.

- As a result it may be worth considering holding onto the existing property if the lender allows you to let the property via the existing mortgage.

However, before you decide to go down this route, you will need to make sure you compare the costs of redeeming your existing mortgage versus the cost of letting a property legally, which could include:

- A charge by your lender to let the property instead of live there.

- Thousands of pounds refurbishing to ensure it is legally and safely let.

- Upfront fees to secure safety certificates such as gas, electric and possibly an Energy Performance Certificate (EPC).

- Letting agent fees, some may take the fee upfront, others via a commission agreement or you should join a landlord association / accreditation scheme to help keep up with landlord legal requirements.

- Depending on local rules there may be a cost of licensing / registering / training for becoming a landlord.

- You will then need to consider a maintenance and repair budget as well as account for void periods, typically around 2-3 weeks where you will have to pay costs without any rental income coming in.

Scenario #6 – Have you considered extending?

- If you are looking at selling your home because you need more space, it may well be you don’t need to move at all as it might be possible to convert a part of your home or extend it.

- For example, relatively cost effective ways to add extra space are converting a garage or outbuilding.

- Adding an office or room in the back garden, or even a single storey extension can all be done on a budget.

- In some areas of the country, the cost of adding extra space may be a lot less than the costs of moving, especially in expensive areas where stamp duty can run into tens of thousands of pounds.

- Some extensions may need planning permission, but, depending on how much the property has been extended in the past, properties can be extended quite substantially under ‘permitted development’.

- Remember, building works will require building regulation approval and sign off.

Top Tip:

Visit The Planning Portal to find out how much you might be able to extend your home by.

- Some properties are ideal to extend such as 1930s/50s homes or Victorian properties as they tend to have good sized gardens so can take an extension on the side or back of the property without eating too much into outside space.

- They also tend to have the ceiling heights that allow the addition of stairs for loft extensions.

- Other properties may be trickier.

- For example if you have a Listed Building or your home is in a Conservation Area, there may be restrictions on extending your home, which may make it tricky to do so.

- And if it’s a listed property or indeed a flat, it could be hard and expensive to extend (especially into the basement).

- In these circumstances it might mean it is better to move to a property the size you need or let the property.

- To help you better understand whether you can or can’t add the extra space and secure an idea of the cost.

Learn more: How to add value to your home

What do you think will happen to house prices?

- The main reason for retaining your current home and letting it would be because you expect property prices to grow.

- If this happens, as well as hopefully covering the costs of owning and letting a property, you would also secure additional equity on the property.

- There are three ways of working out what your property might be worth in the future.

- The first way is to completely ignore what you read in the headlines, as they are unlikely to have any relevance to your property.

Ignore media headlines

Since the credit crunch in 2007 different properties have performed at completely different price growth rates:

- Some have grown in value substantially

- Others recovered their value back to 2007 levels.

- Others have remained below the value they were bought for – despite the fact the recession was over a decade ago.

Use sold price data

One of the most useful ways to work out what a property might be worth in the future is to look at the past property price inflation.

You can do this by checking out the sold property price data which is accessible for free online from:

- Zoopla – https://www.zoopla.co.uk/house-prices/

- Rightmove – http://www.rightmove.co.uk/house-prices.html

- Nethouseprices – https://nethouseprices.com/house-prices/

- HMRC Land Registry – http://landregistry.data.gov.uk/app/ppd/

All you need to do is find properties (similar to yours) and track their sold prices over time.

As long as you are are comparing ‘apples with apples’ then you can make a pretty decent stab at house price inflation for your property.

Let us a standard three bed semi detached 1930s property as an example:

- You find one and it sold for £95,000 in 2000

- Another sold for £187,000 in 2005, estimated inflation over 5 years = 97%

- A similar property sold for £191,000 in 2010, estimated inflation back to 2005 = 2% (credit crunch crash)

- Another sold for £275,000 in 2017, estimated inflation back to 2010 = 44%

- Overall inflation from 2000 to 2017 = 190% or annually at 45% per year.

If you think prices will rise in line with history, a little more or a little less, then you can for example, apply a 4%; 6.45% and 8% annual increase over the next five years to estimate potential growth in equity.

As a ‘worst case scenario’ you can perhaps use the 2% growth seen during the recession period in cases property prices slow as they have done before.

Keep up to date with regional property price forecasts

- Major property research companies such as Savills and Knight Frank (as well as other property pundits) continually crank out house price growth forecasts – normally by region.

- You can apply these regional forecasts to your property’s current value and then use the range of forecasts to predict what your existing property might be worth in the future.

- You can then compare to the forecasts based on similar properties price growth you have calculated using the property sold price data.

Becoming a landlord is hard work

- Many people have been led to believe that being a landlord is extremely lucrative. You just have to ‘sit back’ and watch the money roll in.

- This is sometimes even referred to as ‘armchair investing’.

- However, for those that are good landlords, providing safe and legally let properties and treat their tenants like customers, this couldn’t be further from the truth.

- Landlording can be a 24/7 job for some, especially if the property is an older one such as Victorian, which usually requires on-going maintenance, and repairs or rooms are rented.

- Constant calls from tenants to fix problems in a property, some even expecting their lightbulbs to be changed (which you don’t have to do).

- While in other circumstances you may not hear from the tenant at all, only to find out when you next visit they have trashed the property and left causing thousands of pounds of damage and little recourse against them.

Housing health & safety rating system (HHSRS)

As a landlord you have to keep up to date with rules and regulations, which are enforced by the local authority such as the Housing Health and Safety Rating System (HHSRS).

This includes ensuring a property is safe, taking into account:

- Gas and electrical safety.

- Damp, mould and condensation issues.

- Cold from inadequate heating.

- Trips, slips and falls (e.g. a poorly fitting stair carpet).

- Security issues.

- Poor hygiene (e.g. no seals on kitchen worktops or cracked toilets).

- Fire hazards (e.g. blocked hallways).

Learn more: All you need to know about HHSRS

In addition to all of these rules, over the lifetime of a let you are likely to have to deal with void periods when the property is empty; times when tenants are in arrears but refusing to leave the property and potentially evicting a tenant.

One of these problems on its own can be very stressful, especially if you are a long way away, on holiday or have a busy day job and a family to look after too.

In addition to all of this you’ll need to keep an eye on all of your costs such as letting agent fees, mortgage rates, warranties for works carried out and safety checks and report your earnings to HMRC on time or pay for someone to do this for you.

Working with a letting agents

- Due to the redress available, it’s recommended you use an agent that is a member of ARLA, NALS and/or UKALA.

- When you work with an agent, they should have a set of terms and conditions you both sign.

- This should explain clearly who is responsible for what and if you don’t know how to check the agreement ask a solicitor to do this for you.

Making mistakes

- If you do get things wrong, it is important to know that Local Authorities are being asked to step up their efforts to prosecute landlords who don’t let a property legally and safely.

- In England, they can fine up to £30,000 for each error a landlord makes and in some cases will name, shame and even take to court and secure a jail sentence for those who consistently fail to meet the standards required.

Can you afford to own & maintain two properties?

- Before you commit to owning more than one property, you need to make sure you understand all of the costs involved.

- This includes being clear about what would happen if interest rates rose and knowing what maintenance and repairs are required over the next 5 to 10 years.

- For example, what would your break even be on the let property as far as interest rates are concerned?

- Could you afford to fund both your existing and new property at 5% or a 7% mortgage rates?

- If not, is it possible to fix your mortgage rate?

How do I finance two properties?

- This is something you need to discuss with a mortgage broker who will help you understand what your mortgage payments will be at different levels of mortgage interest rates.

- They will also discuss with you what the pros and cons would be if you fixed your mortgage on one or both properties.

- This may help to reassure you, you can finance the properties while hopefully the equity in both is rising.

- The broker will also help to advise you on how much of a deposit each property will require to ensure you are on the best rates and can afford both properties.

Will I be able to pay the mortgages?

This will depend on the ‘net income’ you earn from rent and from salaries.

If at any stage your costs of running two properties becomes higher than the money you are bringing in, contact your broker or lender to see what options you have available.

It may be possible to agree a mortgage payment holiday. This is when a lender agrees you can either stop your mortgage payments or reduce them for a set period of time (which could be up to a year).

Check first with a broker or your lender if they offer this option and then find out under what circumstances they will offer to help.

Some lenders may require you to:

- Have at some point overpaid on you mortgage

- Have been made redundant

- Need to take maternity

- Have been taken sick

Whatever the reason you need a payment holiday and whatever they say on the mortgage agreement, it is always worth asking ideally before you default on payment so you avoid an issue with your credit file.

However, the fact you have taken a mortgage holiday will appear on your file.

Questions to ask your lender

- Do they offer mortgage holidays?

- How long for?

- What are the criteria to offer this option?

- How do they calculate how much you have to pay back?

- What steps do you need to take to arrange the holiday?

How much will it cost me to live in the new place?

Owning two properties is expensive…

To get an accurate grip on the figures you need to calculate how much it costs to run your new home, as well as how much it costs to run your old property you plan to let.

Annual Cost of Owning Two Properties

| New property to live in (£250k) | Old property to rent out (£150k) | |||

|---|---|---|---|---|

| Mortgage payments | £10,767.72 | (Repayment @3%) | £3,150 | (Interest only @3%) |

| Council Tax | £1,440 | n/a | tenant pays | |

| Utility bills | £1,500 | n/a | tenant pays | |

| Phone / TV packages | £600 | n/a | tenant pays | |

| Insurance | £300 | (contents & building) | £300 | (specialist landlord) |

| Maintenance | £1,000 | £1,000 | ||

| Letting agent fees | n/a | £900 | (@12% of 5% rental yield) | |

| Other landlord costs | n/a | £600 | (certificates, inventory etc.) | |

| TOTAL ANNUAL COSTS | £15,607.72 | £5,950 | ||

| Total annual running cost of both properties | £21,557.72 | |||

| Net rental income | £1,550 | |||

| TOTAL RUNNING COSTS* | £20,007.72 | |||

| *This is prior to tax. Tax is likely to be payable on the income earned and from 2021, mortgage interest relief of a maximum of 20% can only be applied. Please check with a specialist property tax advisor for stamp duty rates which will apply to a second property and the net rental income, minus tax. | ||||

Finally, it’s also wise to work out the future running costs too, say over five years, as costs are likely to go up.

How much should you budget for cost increases?

- The key increase will be your mortgage.

- Your lender or broker should check and advise you on what your mortgage costs be at 5% or 7%?

- Even a small increase in rates can impact quite heavily on your costs.

- In addition, insurance can go up or down, currently this is estimated to increase by £50 in the future due to Brexit.

- Council tax can increase by 5% each year without having referendum on the charge locally.

- TV and phone packages tend to be quite competitive, but you should review them annually as prices can increase faster than inflation, so if you are notified of a price rise, make sure you double check you are on the best rate.

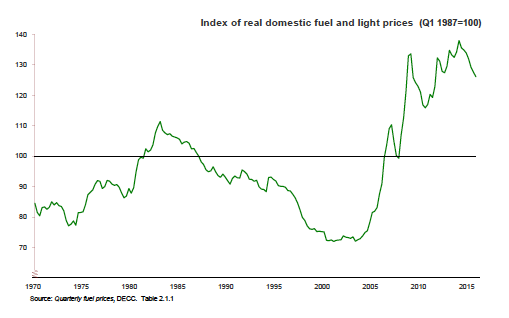

- Utility bill inflation has tended to beat inflation rises, especially since mid 2000.

- Although we’ve seen some falls, overtime, in the main prices have risen by nearly 30% since 2007.

Will renting your old home be profitable?

- If you are letting a property for the first time, it’s important to be aware of all of the costs you are likely to incur.

- This doesn’t just mean the annual running costs, but also the on-going maintenance and repair costs.

- To make money from property a landlord would typically hold a property for 15-20 years.

- In maintenance terms that could be one to two new boilers, possibly new windows, roof, upgrading electrics and even work such as a new damp proof course.

- All of these can add up to tens of thousands of pounds over the time you own the property.

How to do your sums accurately

Doing a budget and keeping detailed accounts for letting a property is not just something you should do, you have a legal duty to do so too as you have to inform HMRC of your earnings – or losses.

There are plenty of software packages you can use to track your income and expenditure.

However to get you started, here is a summary of the annual and maintenance/repair budget while you are letting your home:

Getting ready to let

When you let a property you have to let it legally and safely.

Below is a list of things you need to consider, some of which are a legal requirement nationally, while others may be more localised.

Check the requirements with your local Environmental Housing Officer from the Council or a local letting agent that is a member of ARLA or NALs to ensure you know what is required.

#1: Preparing the property to be let safely and legally

- Electrical check

- Gas safety certificate

- Professional fire safety risk assessment

- Smoke detectors & CO2 alarms

- Any renovation/repair costs

- Pre-tenancy clean

#2: Costs you will need to pay until the property is let

- Mortgage

- Council Tax

- Utilities (water, gas, electric)

- Any service/ground rent charges

#3: On-going annual running costs

- Mortgage

- Agent’s fees (full management)

- Gas/Electric Safety Certificate/PAT inspection/inventory/deposit protection

- Maintenance

- Landlord’s insurance

- White goods replacement – two appliances every 5 years

- Voids, when the property is empty (estimate 1 month per year)

What is the true cost of letting?

The real cost or letting a home is keeping it well maintained and in particular legally and safely let.

This is an example of the types of upgrades you may have to fund over a 15-20 year period:

Typical Costs To A Maintain Buy To Let Property

| Item | cost (year 1-5) | cost (year 6-10) | cost (year 11-20) |

|---|---|---|---|

| Decoration | £1,000 | £1,000 | £2,000 |

| Kitchen (new / upgraded) | - | £4,000 | £5,000 |

| Bathroom (new / upgraded) | - | £2,000 | £3,000 |

| Flooring (new / upgraded) | £150 | £2,000 | £2,500 |

| New boiler | - | £2,000 | £3,000 |

| Electrics upgraded | - | £2,500 | £3,000 |

| Exterior painted | - | £2,000 | £2,500 |

| Guttering / soffits | - | - | £1,000 |

| New windows | - | - | £10,000 |

| New roof | - | - | £15,000 |

| TOTALS | £1,150 | £15,500 | £47,000 |

Mortgage issues when renting out your home

When you let a property with a mortgage you are doing so effectively as a business.

As such, it is vital to know and understand the risks you are taking, what you can do to insure against them and especially the terms and conditions the lending is offered to you from the start and on-going.

First things first – Will your mortgage company let you rent the property?

- Some mortgage companies will be happy to allow you to switch your current residential mortgage to a buy to let.

- This may be at no cost and no change to the terms and conditions, or they may make a small charge.

- Others however may not wish to lend if the property is let, or your rental may not meet their buy to let mortgage criteria.

- This doesn’t mean you can’t still let your home, but it does mean you will have to pay for a new mortgage, which could run into thousands of pounds of additional costs.

Risks you take when letting a property with a mortgage

- The tenant stops paying rent and you still have to fund the mortgage.

- Tenants may sublet the property temporarily through the likes of Airbnb or permanently taking rent themselves from tenants who have not been approved.

- This can render your agreement with the mortgage lender invalid.

- If your tenant looses they job and then goes on benefit, your lender may not permit you to keep this type of tenant.

In addition, the terms and conditions may restrict how you let the property.

For example:

- You decide to let individual rooms in the property when the lender has only agreed to professional lets.

- Some lenders won’t lend if you let the property to family members.

- The lender requires the rent to be a percentage above the mortgage, for example 145%, but if rents dip your rental income may fall below this ratio, which if you need to re-mortgage may be an issue.

Insuring against the risks

Most landlord risks can be covered by insurance and it is vital you seek specialist landlord insurance which can offer you the cover you require to make sure if things go wrong, you can retain your let and avoid unexpected financial issues.

There are the five key risks you should have insurance cover for:

- A tenant stops paying their rent, you have to cover costs such as the mortgage and continue to make repairs, even if they don’t move out.

- The tenant or one of their guests causes ‘malicious damage’ in the home, such as setting up a cannabis farm or breaking the bannisters or bathroom fittings.

- The tenant refuses to leave the property even though they have caused damage and/or are not paying the rent.

- The tenant or one of their guests suffers an accident due to something you didn’t repair, for example falls over a paving slab or a wall or fence falls on them and makes a claim against you.

- The property is damaged by a storm, flood or fire and needs fixing. The tenant too may require re-housing depending on the agreement.

Income tax issues

- Since the credit crunch the government has sought to make buy to let and letting property less attractive to investors, so taxation has not only increased but become more complex too.

- This is partly because letting your home will incur taxation, which will attract some relief, but could also cause you to lose benefits such as child benefit or pay tax at a higher rate.

- Due to the complexity of property taxation, it is essential to seek professional advice so you understand all the taxes you have to pay, what relief you can secure from renting a home you once owned and what benefits you may lose.

Do you have to pay income tax on rental income?

- The answer depends on what you earn currently and which tax bracket you fall into.

- If you earn more income than the personal allowance, you will pay income tax at the rate you currently pay, unless the additional rental income takes you into a higher tax bracket.

How much income tax will you have to pay?

- When HMRC calculate the tax you owe it is based on all of your earnings, not specifically based on buy to let investment itself.

- Unfortunately when you calculate what you earn from your let, you cannot from 2021 deduct mortgage interest and other financial costs from your rental income.

- This can mean you may end up paying more tax than you actually earn from the let. It all depends on your personal circumstances.

- Most couples who let a property will do so with a 50/50 ownership, but it is possible to own any shares you wish between you, for example 80/20.

- However, it is important to be aware you have to declare the percentage of rental income you earn at the same as the split as you own the property.

- For example if one of you is a higher rate tax payer and the other a lower rate and you own the property 50/50, then you have to split the rental income between you 50/50 when you declare your earnings on your tax returns.

- It is not possible for example, to own a property 50/50 and then the lower rate taxpayer to declare 100% of the rental income on the tax returns to pay lower tax.

- Nor is it possible if as parents you have invested in a student let which you own for your child to declare the rental income as theirs and therefore pay no or lower rates of tax.

Will you lose any benefits?

- Any benefits you earn, such as child benefit is dependent on your income, so if you increase your income through renting a property, you may take your earnings over the threshold and the government may then take benefits away.

- Other benefits you may lose are your personal allowances.

Capital Gains Tax (CGT) issues

- Capital gains is a tax you pay when you purchase an asset such as stocks and shares, gold or a property and sell it for more money.

- Everyone has an entitlement to an annual allowance, but this can only be used once each year.

- When you let out your home, the good news is there is some relief which can reduce your tax bill.

- Seek advice from a specialist property tax expert to ensure you take full advantage of capital gains allowances and tax relief.

What is Capital gains Tax (CGT) on property?

When you make money from an ‘asset’ you invest in, you have to pay tax, if it is above the annual allowance.

Using a very simple example of Capital Gains Tax (CGT):

- If you buy a property for £100,000

- Sell the property for £150,000

- The capital gains allowance in 2017/8 is £11,300

So, in the above example, you would pay tax on £150,000 – £100,000 = £50,000 – capital allowance of £11,300* = £38,700

The CGT rate you would pay would depend on your earnings for that specific year:

- If you are a lower rate tax payer it would be 18%

- A higher rate taxpayer would pay 28%.

- If you are normally a lower rate tax payer, it doesn’t mean for the year you sell a property you invested in you would remain so, it may be you are pushed into a higher rate tax position, so do check this with a tax expert.

*Tax and the allowance you pay can change at each budget, so please check the latest information:- https://www.gov.uk/capital-gains-tax/allowances

What are the ways to mitigate CGT?

Capital Gains Tax is complex and to mitigate what you pay requires planning.

You cannot ‘avoid’ paying the tax you owe, that is illegal, but it is possible, if you plan effectively, to keep the tax you pay to a minimum, especially when it comes to CGT.

The key areas you can reduce the CGT you pay include:

- Maximising the annual allowance you have either by ensuring two of you claim what you can and/or selling properties over a period of time rather than in one or two years.

- Claiming the Private Residential Relief you can for the period of time you lived in the home and for the last 18 months you owned the property before you sell, whether you lived there or not. See: https://www.gov.uk/tax-sell-home/let-out-part-of-home

- Deducting expenses such as stamp duty (including the additional 3% you have to pay on purchase if it is a second home); costs of buying and selling a property and improvement works such as adding an extension or lease enhancements.

- See: How to avoid capital gains tax when selling a house

What is the percentage of Capital Gains Tax on property in the UK?

- If you invest in assets other than property, lower rate tax payers pay 10% CGT and higher rate pay 18%.

- However if you invest in property you will pay 18% on the net gain as a lower rate tax payer and 28% as a higher rate tax payer.

Do you have to pay CGT is you sell your house?

- If you sell your home and it’s your only property and has been declared or is obviously your main residence, you will not pay any capital gains.

- However if you let a property you once owned, you are likely to pay capital gains, depending on your personal tax position.

- This can also be the case if you transfer a property to a company or to someone other than your spouse.

- If the amount you earn from the property is less than your CGT allowance, or you have made losses you can deduct, then you may be able to mitigate your CGT bill.

Bear in mind if you are:

- Married, you cannot elect to have two different ‘main residences’.

- Letting your home and buying a new property to live in as a main residence means you will need to declare this to HMRC and confirm which one will be your main residence.

- Transferring property to anyone other than your spouse you may incur Capital Gains Tax .

Other allowances & taxes to be aware of

Stamp duty

- When you purchase a property for more than £40,000 which is classed as a ‘second home’ you will have to pay an additional 3% stamp duty on the full value of the property at purchase.

- This is in addition to the stamp duty you would pay as a normal homeowner.

- See: Everything you need to know about Stamp Duty Land Tax (SDLT)

Inheritance tax

- If you gain an additional property due to inheritance, you may have to pay tax on the property’s value.

- Allowances are available to those who let a property.

Wear and tear allowance

- It is possible to deduct genuine purchases you make for your let.

- For example if you let it furnished and have to replace the items post a tenancy, then the costs can be deducted from your rental income.

Deductible expenses

- When you let a property you are essentially running a business so it is possible to deduct expenses you incur during the time you let a property.

- This can include work to maintain the property such as re-decoration or bills you might incur such as council tax, landlords insurance, letting fees and things like phone calls with tenants.

- Tax and property are increasing complex and essential to get correct, both from a legal perspective and also to ensure you pay as little as you need.

- To ensure your tax is accurate, do seek specialist advice from a property tax expert.

How to rent out your house (step-by-step)

Step 1: Seek your lenders permission in writing to let your original home or choose a new mortgage.

Step 2: Decide whether to let yourself or use a qualified agent who is a member of ARLA, NALS, RICS or UKALA.

Step 3: If you let yourself, join a landlord association or accreditation scheme.

Step 4: Find out if you need a licence or need to register yourself as a landlord or / the properties you let.

Step 5: Know the 29 rules from the Housing Health and Safety Rating System (HHSRS) via your local authority.

Step 6: Organise specialist landlord insurance.

Step 7: Understand the current market and which properties you are ‘competing against’ for tenants.

Step 8: Agree the level of rent to advertise. Unlike selling a home, rents tend to be advertised at the amount you will accept as a landlord.

Step 9: Check locally which property sites you need to advertise on to secure a tenant.

Step 10: Understand, or pay an agent who understands the 400+ rules and regulations required to let a property legally and safely.

Step 11: Know how tenants are being referenced.

Step 12: Check with your agent to make sure the tenant receives all the prescribed information such as ‘How to Rent’ guide from the government and safety certificates.

Step 13: Ensure or carry out yourself the ‘Right to Rent’ checks on any new tenants.

Step 14: Budget for times when the property is let and problems occur such as the tenant doesn’t pay their rent or the property is empty for a month or more.

Step 15: Reference your tenants – Comprehensive referencing includes affordability, employment status and credit checks, as well as a reference from a previous landlord

Step 16: Ensure the tenants deposit is protected. See: https://www.gov.uk/tenancy-deposit-protection

Step 17: Organise an inventory either through your letting agent or via a clerk who is a member of the Association of Independent Inventory Clerks or an ARLA Inventories provider

Step 18: Check for tenancy agreement updates and understand the rights and responsibilities of yourself as the landlord and your tenant.

Step 19: If your tenant reports a repair, ensure you get back to them within 14 days

Step 20: Ensure you fill in your tax returns correctly and on time.

Step 21: Be aware that from April 2017 local authorities can fine landlords in England up to £30,000 per problem found in a let property, so it is essential you make sure you let your home legally and safely, even if this means spending thousands of pounds fixing problems you were happy to live with.

Note: The above guide is for England only.

- Scotland – see: mygov.scot

- Wales – see: rentsmart.gov.wales

- Northern Ireland – see: nidirect.gov.uk

How much can you rent your house for?

- Renting a property is different to buying.

- Most tenants look for properties they can afford and offer the rent the property is being advertised for.

- Smart landlords typically let a property for slightly below the local average.

- This is because a ‘void’ i.e. the time the property is left empty is often worse financially than it is to accept a slightly lower rent.

- For example, if you are hoping for £600 a month rent, but advertise the property for £595 and secure a tenant straight away, you will only be losing £5 x 6 months = £30.

- If your property takes a month to let though, it would cost you £600.

- Speak to your local lettings agents & check on Rightmove or Zoopla to see what rent is being asked for comparable property in your area.

What about AirBnB?

With the new ‘digital age’ now affecting the property market we are in a strange situation where successive governments have dramatically increased the legal requirements to let a property to tenants.

While on the other hand they are allowing anyone to rent out their property for short periods of time, for example for a weekend, weeks or months at a time with no legal checks whatsoever.

The problem with this is that if you let your property even for a weekend you may be breaking terms and conditions set by your lender and insurance company, so if anything happens while the temporary tenants are in your property, you may not be covered.

Before you decide to let your property, especially your own home, make sure:

- You check how much you can charge each night for your property.

- Work out what it will cost you to prepare and let the property.

- Find out if your lender and insurance company will be happy for you to let on sites such as Airbnb.

- Ideally make sure the property is safe to let, including gas and electrical safety checks.

- Understand what happens if the tenants damage the property or won’t leave.

- If you let your property with sites such as AirBnB it can be lucrative, but it is very different to renting privately to long-term tenants and you need to understand the pros and cons of letting a property temporarily.

- If you do let your property to long-term tenants, also check on a regular basis whether your tenants are illegally subletting.

- Do a search on a quarterly basis to ensure your property is not being advertised without your knowledge.

- Another way to check whether tenants are letting your property illegally is to ensure you have a good relationship with your neighbours so if they see anything suspicious, they are happy to call you so you quickly know there is a problem with your let.

What is ‘Let to Buy’?

- Let to buy is where you, the homeowner, lets out your current home to allow you to purchase and move to a new one.

- This might be because you can’t sell or you are temporarily being asked to move for work, either abroad or within the UK.

- What “Let to Buy” allows you to do is to secure a buy to let mortgage on your existing home and release enough cash to afford to buy a property in the new area.

Key considerations

- Work out whether your existing lender will allow you to ‘let to buy’ or if you will have to take out new mortgages.

- Find out the initial costs of re-financing and running two mortgages.

- Understand the tax implications such as an additional 3% stamp duty on second homes.

- Find out how much you might have to spend on your own home to let it legally and safely to tenants.

- Talk to local letting agents who are members of ARLA, NALS and UKALA.

- Understand yours (and your tenants) rights and responsibilities as a landlord.

- Could you buy a bigger property and incur less tax in the new area, compare this to keeping your existing home and letting it out while buying a second to live in.

- Are prices and rents likely to rise or fall in the existing and new area?

- Work out a maintenance and major works schedule.

- Know the tax you pay to purchase another home if you own an existing one, the tax you will need to pay while letting and the tax when you sell.

Common questions

Is it illegal to rent a house without a buy to let mortgage?

- You cannot let a property to tenants, including family and friends without notifying and agreeing with your lender and if a flat, your freeholder.

- You may also not be able to let a property if you have bought a property under the Help to Buy Scheme, until the government loan has been paid off and similar is likely to apply for shared ownership properties.

- If you own the property outright and have no mortgage, just check there are no covenants or reasons why you can’t let the property, for example if it is a flat the leasehold agreement may not allow it.

How much can I rent my house for without paying tax?

- This is different for everyone. However, if you own a property and your share of that property allows you to earn the personal allowance, which in 2017/8 is £11,500.

- Always double check the tax implications of letting a property before you decide to go ahead, it may show you would be better off selling and investing your money in other assets in light of the high levels of taxation.

- See: Current rates & allowances (GOV.UK)

What is a buy to let mortgage?

- A buy to let mortgage is a specific type of loan used to buy a property, which is then let, to tenants in the private sector.

- Some lenders will restrict the type of tenant you can let to, for example some won’t allow you to let on a room only basis or to tenants who are on benefits.

Is a buy to let mortgage more expensive?

- Yes.

- However, rates tend to be slightly higher than ordinary residential mortgages, but can be secured on an interest only basis, so the payments can be quite small in comparison to rents received.

How much deposit is needed for a buy to let mortgage?

- Buy to let only works financially to deliver a profit in some areas if you put down a very high deposit – over 50%. In other areas, deposits may be as low as 15-25%.

- Do check though that the property will generate enough additional monies so you can afford maintenance and major upgrades when required and still make a profit.

How do you sign up for Airbnb?

- Before you sign up to Airbnb you need to decide whether to rent your whole property, let a room or allow people to rent a shared room.

- You will need to write a description, take some photos and have an idea of what rent to charge.

- You can do this yourself or outsource the whole process to a company like Airsorted.

- Learn more: Visit AirBnB

Summary

- Letting a home is not a small ‘job’ or something to do as a ‘hobby’.

- A legally and safely let property has to meet the 400+ rules and regulations and if you are caught cutting corners, it could cost you £30,000 for each missed rule and/or regulation.

- The tax implications of letting a property are enormous too and extremely complex.

- Anyone looking at letting for the first time should understand the tax to buy, let and sell an investment property.

- So before you decide to let your existing home, be clear on what will happen when you own two properties and intend to sell.

Further reading & helpful links

- The Planning Portal

- A landlord’s responsibilities (GOV.UK)

- Rent Smart Wales

- Renting Scotland

- Northern Ireland Landlord Advice

- Stamp Duty Land Tax rules (GOV.UK)

Related guides

- The ultimate home selling guide (step-by-step)

- Should you buy first or sell first?

- When is the best time to sell?

- How long should it take to sell?

- How much should selling cost?

- How to prepare your house for sale

- Capital gains tax when selling a house

Related guides

Did you

know?..

The hotter your market

the easier your sale...