Definitive guide:

What Comes First? Sell Your Old Home or Buy a New One?

And what to do if it all goes wrong!

2024 update

Keep reading to discover….

- Insider secrets from serial house sellers

- How to survive being in (or breaking) a property chain

- When best to buy first, sell first or do both at the same time

- And lots more…

Table of Contents

-

Key takeaways

-

No you're not going crazy!

-

Revealed! Discover the revolutionary FREE tool 1,000’s of SMART home sellers like YOU are raving about

-

What estate agents are thinking (about you)

-

Why you should consider market conditions

-

Should I buy before selling?

-

Should I sell before buying?

-

Compare your local estate agents

-

Property chains: How to survive selling & buying at the same time

-

Buying & selling at the same time (step-by-step)

-

Compare your local estate agents

-

Making an offer on a house before selling yours

-

Contingencies & how to break the housing chain

-

Find the best estate agent for your sale

-

Related guides

Key takeaways

- There is no one ‘right way’ to move home – there are advantages and disadvantages to buying first, selling first and doing both at the same time.

- Your choice of estate agent and conveyancing solicitor will directly impact your chances of moving and securing your preferred property.

- Buying and selling in a chain is risky business – that’s why chain-free properties and chain-free buyers are so sought after.

FREE tool: Find expert agents to help you sell your home

No you're not going crazy!

For many, planning a home move is confusing. Real ‘chicken or egg’ stuff:

A) Do you sell first make yourself homeless and rent?

Or…

B) Do you buy first (if finances allow) without the peace of mind of knowing what price your old home will achieve (or how long it will take to achieve it)?

Or…

C) Do you make an offer, cross fingers and hope your seller doesn’t get a better offer while waiting for you to sell?

We’ll cover all these in detail but first, a quick quiz…

Q. What are the most dangerous words you can hear when moving home?

A. “Darling, we’ve nothing on this weekend so what say we pop over to St Albans, just to take a look”

This is the kiss of death!

We can guarantee you’ll be innocently browsing an estate agent’s window when suddenly:

1. You’ll see something interesting

2…Go for an impromptu viewing

3……Fall in love and make an offer

4………Have that offer accepted!!

Now you’re in a real pickle – you’ve got to shift your old home quick smart and you’ve done zero planning. You’re totally on the back foot.

Or at least, you would have been…

…Our sincere hope is that this guide gives you the ability to take greater control over your move, and approach it in a more strategic way.

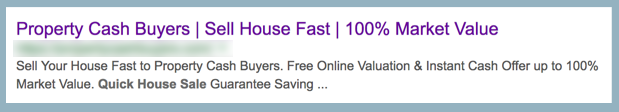

Revealed! Discover the revolutionary FREE tool 1,000’s of SMART home sellers like YOU are raving about

All estate agents claim to be the “best”, but how do you know for sure which one is telling you the truth?

It’s worth doing your research because the wrong estate agent is likely to undersell your home by £10,000’s.

That’s why we’ve teamed up with GetAgent (the estate agency performance data specialists), to help you take the stress and guesswork out of choosing your estate agent.

Find out which local agents REALLY are best at selling property like yours.

Don’t guess. Know…

What estate agents are thinking (about you)

Before we dive in and discuss strategy in detail, let’s take a look at things from an estate agent’s perspective.

Worth doing given an estate agent will likely be the gatekeeper to your new home.

The key insight is this:

As a buyer, when you register with estate agents, they will (consciously or subconsciously) be assessing your position (i.e. your ability to proceed with a purchase) and grading you accordingly.

They want to know if you’re a ‘hot’ buyer, a ‘warm’ buyer or just a ‘tyre kicker’.

From a buyer’s perspective you may feel this is wrong and unfairly judgmental.

From a seller’s perspective you may think “too right, no tyre-kickers please”.

Nevertheless, here’s the reality – Hot buyers tend to get preferential treatment.

- Their offers are put forward with enthusiasm.

- They’re the first applicants an estate agent will notify when new property comes to market.

- It’s not unusual for ‘hot’ buyers to get a ‘heads up’ or chance to view (and offer) on property before it comes to market.

Undoubtedly, given the way today’s estate agency industry works, there are benefits to being judged as a ‘hot’ buyer.

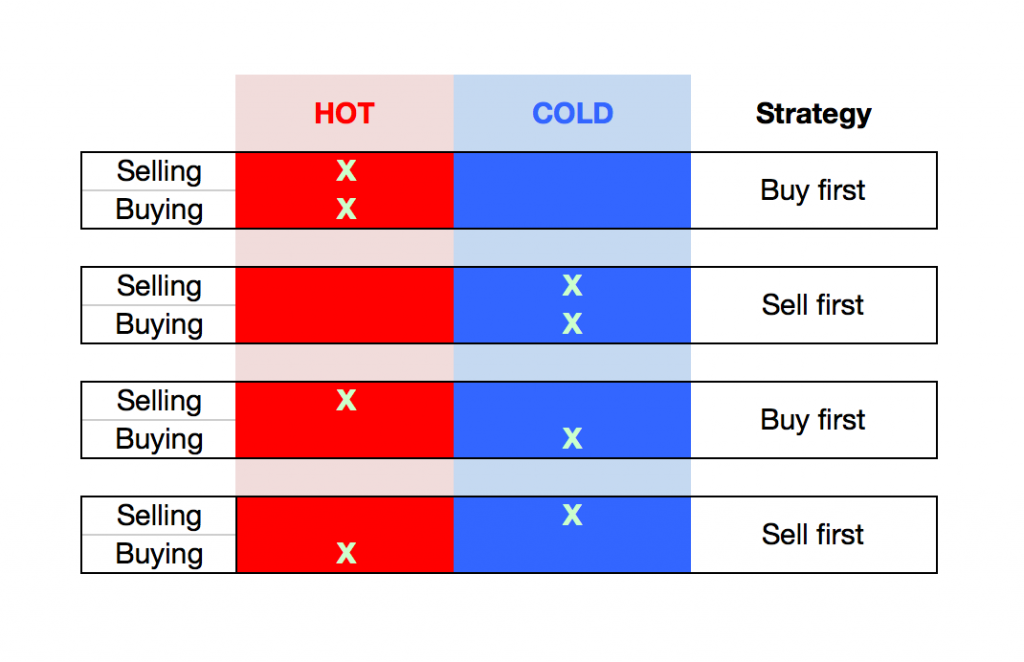

4 little boxes of judgement

As a buyer, estate agents will put you in one of four boxes:

Box 1: ‘NTS’ – Nothing to sell

Estate agents love these guys.

Having sold and gone into rental accommodation for example, you know exactly what you can afford to buy, there is no chain below you and you can proceed immediately.

Congratulations, you’re a ‘hot’ buyer.

Box 2 : ‘U/O’ – Under offer

If you’re under offer you’re highly motivated and now know exactly what your buying budget is.

Of course, deals fall apart all the time between offer acceptance and exchange of contracts but nevertheless, this is a great position to be in if you want to be judged as a ‘hot’ buyer.

Expect preferential treatment with a few caveats because a proper estate agent will also be taking into account the following (and consciously or subconsciously, up or downgrading you):

- How far the offer on your home has progressed?

- What the situation is with your buyer’s sale (if applicable)?

- Whether or not you’re selling via a traditional (or internet only) estate agency that has a poor reputation for effective sales progression.

Box 3: ‘PTSOM’ – Property to sell on market

Don’t expect quite so much love in this position.

You’ll still get a fair bit as clearly you’re highly motivated, just not quite in a position to proceed immediately.

A good estate agent will actually try to access the health of your sale (even speak directly to your selling agent).

They will get a feel for how close you may be to being under offer and starting to look like you can proceed on a purchase.

Types of things good estate agents will be looking at (and grading you on) are:

1. The length of time you’ve been on the market?

- Short time = good

- Long time = bad

2. How hot or cold is your market?

- Hot market = good

- Cold market = bad (especially coupled with being on the market a long time)

3. Are you on at a realistic price?

- Realistic price = good

- Unrealistic = bad

4. Which estate agent are you using?

- Quality local estate agent = good

- National internet only / hybrid estate agent = bad

Box 4: ‘PTS’ – Property to sell

This is a buyer that has a property to sell but not yet put it on the market.

Many estate agents view this as the weakest position for a buyer to be in.

Even if you walked into an estate agent’s office and offered full asking price on a house, many estate agents would advise their client’s to reject your offer.

The reason being, these buyers simply don’t know their true buying budget at this time.

- After all, without knowing your selling price you can’t know your true buying price.

- Even if you’ve had valuation opinions from estate agents, until your property goes to market, these figures are theoretical.

We don’t want to sound alarmist but with such endemic levels of ‘deliberate overpricing to win the instruction’ prevalent in the EA industry, these figures could be well out of sync with reality. The property you’ve fallen in love with could well be financially out of your reach.

- This will be a fundamental problem for you and a huge waste of time for everyone else.

A switched on estate agent will take a slightly different view, especially if you have a house to sell locally (as they will want to sell it for you):

- True, any offer you make at this stage may be seen as second-class but the agent will certainly be keen to get you viewing their properties.

- These viewings are a perfect opportunity to get to know your moving goals & offer to help sell your home.

- It’s an instruction winning opportunity for switched on estate agents and not necessarily a bad thing for you either.

- For example, if the seller of a property you’re interested in has yet to find somewhere to buy / move to, having the same estate agent as them can help create a win-win scenario for all involved.

Why you should consider market conditions

To make the best of your position as a buyer or seller, you must have a firm grip on the true state of each market you’ll be buying and selling in.

For example, if your sales market is cold market (i.e. a buyer’s market), then making an offer on new home (before your old one is ‘under offer’) is likely to end in disappointment.

Step one

Step two

- Use the decision making cheat-sheet below to find the best strategy for whether you’re buying or selling in a hot or cold market.

Should I buy before selling?

If you’re able to fully fund your purchase without needing to sell your old home, or want to keep hold of it as a rental investment, buying first has it’s advantages.

Advantages:

- This is the least stressful way to buy & sell.

- You can take your time and choose a new home without the pressure of needing to sell your old one.

- You can attempt to ‘time the market’ by buying when the market is cold and selling when the market is hot.

- You’re less likely to be gazumped and will be in a strong negotiating position – if your purchase is not dependent on a sale, then you’re now a cash buyer that is ‘proceedable’ and ‘chain-free’.

Disadvantages:

- Very few home movers (especially those upsizing) are lucky enough to have the funds needed be able to make a ‘non sale dependent’ purchase.

- You will need to be up-to-date on Stamp Duty Land Tax rules relating to the purchase of second homes and Capital Gains Tax rules relating to the sale of none principal residences.

Let To Buy

If you want to buy a new home but don’t want to sell your existing residence, have equity locked up in it and feel it has good rental potential – Let To Buy may be an option.

What is it?

This is where you remortgage your existing property (changing it to a Buy To Let mortgage product) and simultaneously purchase a new main residence with a new mortgage.

- Equity in your existing property gets released so you can pay the deposit, SDLT & any other purchase fees on your new home.

- You will have two mortgages.

- The Buy To Let mortgage on your old property should be covered by rental income, but check net income with a property tax specialist.

- You will have to pay an additional 3% SDLT surcharge on your new purchase.

- Let To Buy can be used as a legitimate chain-break solution if your property is proving hard to sell.

Consent To Let

This is when you ask your current mortgage lender for permission to rent out the property, without having to change mortgage product.

- Permission is granted at your lender’s discretion.

- If your financials allow for it you can apply for another residential mortgage to finance your new home purchase.

- Consent to let is usually a short-term solution most often used when you don’t have the equity needed to secure a Buy to Let mortgage.

- Consent to let typically (but not always) has a time limit on it or may need to be renewed, for example, annually.

- At the end of that period you will either have to sell the property or switch to a Buy To Let mortgage product.

- Expect your lender to charge you an admin fee.

- Some lenders will also increase your mortgage rate by 1-2% to compensate for the additional risk of rental property experiencing void periods.

Tax implications of owning more than one property

Buying (and owning) an additional property carries extra costs.

Make sure you account for the following:

Stamp Duty Land Tax (SDLT)

- As of 1st April 2016, anyone buying an additional residential property worth more than £40,000 has to pay more tax.

- You now have to pay an extra 3% Stamp Duty Land Tax (SDLT) surcharge on the purchase, although it’s charged on properties over £40k, you still pay the additional 3% on the full value.

- Example: If you buy an additional property at £350,000 – You will now have to pay the standard rate of SDLT (£7,500) + and additional 3% of the entire purchase price (i.e. £10,500).

- In the example above, your SDLT liability now jumps from £7,500 to £18,000.

- HMRC will refund you the full 3% SDLT surcharge if you sell your existing home within 36 months of purchasing the additional property, as long as you are considered to have ‘swapped’ one primary residence for another.

- The refund is not automatic – You have to jump through some administrative hoops and apply directly to HMRC.

Links

- Stamp duty land Tax (GOV.UK)

- Stamp Duty Calculator (GOV.UK)

- SDLT: Buying an additional residential property (GOV.UK)

- SDLT: Apply for refund of 3% surcharge (GOV.UK)

Capital Gains Tax (CGT)

- When you only own one home there is no Capital Gains Tax to pay when you sell it (this is due to a tax relief called private residence relief).

- However, if you buy another property to live in and at a later date sell the old one, that sale will most likely be subject to Capital Gains Tax.

- As a married couple you can only elect to have one primary residence.

- Current tax rules allow you to hold on to the old home for 18 months before Capital Gains Tax liability kicks in.

- This “grace period” used to be 3 years but reduced to 18 months in April 2014.

- Your CGT liability will be based on the amount the property has increased in value during your time of ownership.

- You do have a CGT allowance that can be deducted and if two or more of you own the property, each of you benefit from your individual allowance. However it applies to all your capital gains, not just property, but shares and asset sales too.

- You can deduct the cost of any improvement work you’ve carried out and also the transactional costs of buying & selling the property (SDLT, solicitor fees, Estate Agent fees etc.).

- Speak to a property tax expert or specialist accountant before you commit to buying an additional property to fully calculate your potential stamp duty and CGT liability and explore how best to minimise your liability.

Links

Should I sell before buying?

Most estate agents will encourage you to do this but in truth, there is no right or wrong in this, just advantages & disadvantages to be aware of.

The #1 Advantage

Selling first puts you in a strong buying position because you are then ‘non-sale dependent’ and so the seller (and their estate agent) will view your offer more favourably.

Other advantages

- Potentially your sale will be a less stressful experience because you’ll have more time and a clearer head with which to plan and execute your sale.

- When your find yourself in a situation where you ‘need’ (as opposed to ‘want’) to sell, you immediately weaken your negotiating position – Selling first puts you in a stronger position when negotiating with buyers.

- With money in the bank from your sale, you can have 100% confidence in your purchasing budget – It is only when you’ve sold that you truly know what your maximum offer level (on a new home) can be.

- Compared to any competing buyers that have property to sell, your seller and their estate agent should view your offer more favourably – You have more chance of securing the property (potentially even at a lower price).

- Your seller will be more inclined to take their property off the market while you’re progressing your sale – this will significantly reduce your chances of being gazumped.

- If sellers in your market are struggling, being able to advertise your property as ‘NO ONWARD CHAIN COMPLICATIONS’ will help you stand out and increase the saleability of your property.

- You won’t need to fund the additional (albeit refundable) 3% SDLT surcharge on second home purchases.

- It’s easier to get a mortgage as your affordability is increased thanks to not having to also service the mortgage on your old homes.

- If you plan to buy a property in a weak / cold / buyer’s market, you may well increase your buying power – a) Being a chain-free ‘hot buyer’ gives you the strongest negotiating position possible. b) Prices of the homes you’re after are likely to be softening. c) The sellers of these homes are likely becoming more motivated to strike a deal. d) If you sit on the sidelines and prices continue to fall, you may well be able to purchase considerably more property for your money – especially beneficial if you’re upsizing.

The #1 Disadvantage

Potentially you have to move into rented accommodation and remain there unsettled for an unknown amount of time – it’s the emotional strain caused by the uncertainty of it all that most people find hardest to deal with.

Other disadvantages

- Without having found a new home to buy, it can be argued you’ll be less motivated to set a realistic price for your sale and be less critical of pricing advice presented by estate agents trying to win your instruction.

- Having sold first and achieved a price you’re happy with, you have no idea if this will be enough to allow you to purchase the right property when it turns up.

- Without having found a new home to offer on, you don’t know how much you ‘could’ accept for your old home.

- In an attempt to hold out for the maximum possible sale price, you may inadvertently turn down early offers, that may in fact have been acceptable had you already found a home to move to.

- There is increased potential for ‘buyer’s remorse’ – The pressure to find a new home may cause you to make a rushed & poor buying decision.

- The cost of going into rental accommodation (and the time you’ll be there) will eat into your buying budget.

- Not only will there be two removal costs to budget for, most AST tenancy agreements are for a minimum 6-month period.

- If you find a new home within that time you’ll still have to cover rental payments for the whole 6-month term (unless negotiated differently at the outset).

- If the area you want to move to is a strong / hot / seller’s market, and it takes time to find a suitable property to offer on, you lose ground.

- As house prices rise, your buying power is eroded and you can find yourself priced out of that market.

A word about renting

Most seasoned sellers don’t mind renting. Once you’ve been part of property chain renting is often seen as the less stressful option.

- There is not typically a shortage of good quality rental accommodation across the UK.

- It’s pretty easy to find a short-term let at a reasonable price.

- Having to get the removal men in twice used to be the big turn-off – These days it’s not such a big deal.

- Most decent removal (and storage) companies will take your belongings and store them for you while you rent (at a very reasonable cost).

- When you find your new home they’ll retrieve your belongings and bring them to your new home.

Is renting really the only option?

Consider the following:

- Can you strike a deal with an AirBnB host?

- Can you move in with family or friends?

- Can you get discounted rates from a local B&B?

- Do you know anyone with a holiday home you could have use of?

- Would renting a caravan or chalet on a holiday park solve short-term accommodation needs?

- Could you buy a caravan and sell it on after your move?

None of these will be ‘home sweet home’, but perhaps, just enough to keep you housed during your home search.

Compare your local estate agents

Compare local estate agents based on the facts: how quickly they sell property, how close they come to achieving the asking price and how successful they are.

Our free, impartial estate agent comparison tool gives you this data instantly for the estate agents in your area.

Property chains: How to survive selling & buying at the same time

Ok, so you don’t have the cash to buy a new home, move in and then leisurely sell the old one.

And you don’t fancy taking voluntary homelessness or becoming a tenant again.

So what to do?..

…You try to link your sale and purchase together forming a property chain.

If it all goes smoothly, it’s the least disruptive way of doing things and carries the least amount of financial risk.

However, it’s not without it’s problems and disappointments.

Your stress levels will be reduced, and chances of moving success increased, if you take a moment to understand:

- What being in a chain entails.

- The risks involved.

- The contingency plans to have at your disposal if you need to suddenly ‘break the chain’ to keep your move on track.

Remember, finding a buyer is often the easy bit. It’s what happens next where the real trouble begins (and where a proper estate agent provides the most value).

What is a property chain?

In essence, a property chain is a series of linked transactions that form when people need the money from their sale to allow them to finance the purchase of their new home.

A chain starts with someone that is buying (but not selling) such as a first time buyer or investor.

It ends with someone that is selling but not linking that sale to a purchase such as a probate sale (when someone dies), or sale where the homeowners are moving into rental accommodation, retirement home or new build property.

Worth a read: The Chain: Unravelling the links between sales

Basic facts

- No one in a chain is able to exchange contracts or complete until everyone is the chain is ready.

- Chains move at the pace of the slowest link.

- The longer the chain – the greater the risk of delays or breakdown somewhere along the chain.

- Average chain length in the UK is 3 links.

From ‘offer acceptance’ to ‘completion’

- Only when all parties in the chain exchange contracts are all parties legally bound to complete on their transactions.

- Failure to do so puts you at risk of facing financial penalties.

- Achieving ‘exchange of contracts’ is certainly a time to breath a sigh of relief – You will have had to dodge many bullets to get there.

Why a good estate agent is worth their weight in gold

- From offer acceptance to exchange of contracts, it’s your estate agent that will be your greatest ally.

- Your solicitor’s help will be limited as they’re only able to speak to the solicitor one step up or down the chain.

- A proper estate agent will be tracking all the buyers and sellers in a chain. This enables them to identify any potential issues, pinpoint problems and find solutions before the chain collapses.

- There are a million different things that can affect the health and stability of a chain.

- An experienced local estate agent that has the willingness & ability to get ‘stuck in’ is invaluable here.

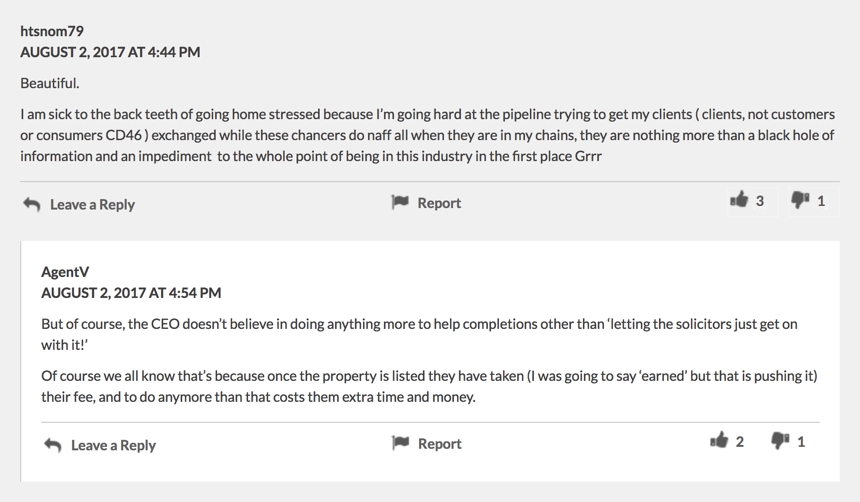

- Online & hybrid estate agents do not have the greatest reputation for ‘chain management’ or ‘buyer vetting’.

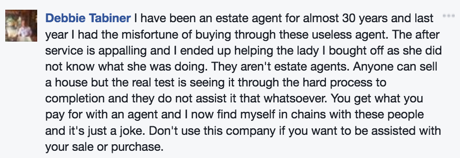

That last point about cheap online / hybrid agents is worth labouring!

Below is a comment from one frustrated high street estate agent posted recently on a leading estate agency industry trade website.

A true story: Selling Rumbolds Road

“Imagine your buyer is trying to push back the agreed exchange date so they can get a specialist electrical report on your property.

This request comes totally out of the blue and it wasn’t a condition of their offer (or your acceptance of their offer).

Perhaps they’re trying to put together evidence to use in an attempt to reduce the agreed sale price!?

What do you do?..

…Your EA needs to make a judgment call and provide advice.

Do you allow the buyer to get their report (and hold up the chain)?

Or do you call their bluff, threaten to put the property back on market & potentially lose your buyer altogether?

If you don’t have a good estate agent by your side (to guide you) you’re unlikely to make the right call.

Thankfully the estate agent (I was using) had detailed knowledge of this buyer’s motivation / position and so we called his bluff.

We exchanged the next day and no more was mentioned about the electrical report.

I was definitely in two minds about doing this & without the agent’s expertise / guidance, I could easily have made the wrong call.”

One more quick tale from the trenches

Here are some interesting insights into what really happens between offer acceptance & exchange.

From AgentV (a passionate independent estate agent) commenting on a PropertyIndustryEye article:

“In the past three months we would have had a third of our sales fall apart completely, if we had just left it to the solicitors and we hadn’t have done all we could to chase, check, cajole, reason, address and hold hands with all the parties concerned.

Examples include where someone was threatening to pull out because of the time needed for final completion, and the conveyancer couldn’t be bothered to explain to the vendor that it would take five working days for the money to be drawn down from the buyer’s lender.

Another where arguments have broken out between solicitors blaming each other about whether a query raised late on, to be sorted with indemnity, could have been or was raised earlier.

And examples where a MOS (memorandum of sale) had been sent out and weeks later a chase has revealed the solicitor has not started the process because they have not had the pack back from their client, but equally have not chased them or even asked us to chase them.

Oh by the way in the first example, the solicitor told me their client had pulled out and quote ‘There’s nothing more I can do and I am not going to waste any more of my time on it’.

And if we hadn’t have acted, who else would have?

We had a vested interest in it completing, but more than that…. I cared about the buyer losing a property they really wanted!”

Setting completion dates

- The completion date is the day money changes hands; you get the keys to your new home, take legal ownership and move in.

- Because this date has to be the same for all parties in the chain, your conveyancer and estate agent need to take an active role in making sure everyone is happy and in agreement.

- Success requires a delicate touch (especially from your conveyancing solicitor) and willingness to compromise from all members of the chain – it should be viewed as a team effort.

- You will need to be ready willing & able to compromise (within reason).

- The completion date can only be finally set once exchange of contracts (on all transactions in the chain) has taken place.

- Exchange of contracts can only take place once solicitors for all buyers and sellers in the chain have satisfactory answers to all legal searches, enquiries and the agreed deposits are being held by solicitors.

- If buying with a mortgage, buildings insurance for the new property has to be in place to exchange, including a policy number.

- Solicitors will also need to be sure all legal requirements imposed by any buyer’s lenders have been complied with.

- Until exchange of contracts has taken place, any moving dates mentioned are subject to change.

- Secure quotes, but don’t book an exact day for removal men until you get confirmation of a definite completion date from your solicitor.

How to avoid completion day delays

Your solicitor will need money from your sale transferred to them before they can send the money needed to complete on your purchase.

In turn your buyer’s solicitor will need to be in receipt of funds from your buyer’s buyer.

- Any delay from the bottom of the chain will impact all the way up the chain.

- As such, the longer the chain, the greater the risk of delay.

- When lenders are involved, delays can happen due to high volumes of transactions taking place on the same day.

You can reduce the risk of delay by avoiding traditionally high volume completion days such as;

- Fridays

- The last working day before a bank holiday

- The last working day of the month

Late completions & failure to complete penalties

You do not want to miss the completion deadline (usually 1pm).

- Funds received after 1pm will be treated as being received the following working day (that’s Monday if you were due to complete on a Friday).

- Your seller will be within their rights to refuse handing over the keys to your new home until completion monies have cleared.

If you default and fail to complete entirely, you risk being in breach of contract.

- You risk losing your deposit (and your new home).

- You also risk the seller suing you for legal costs.

- If they then have to sell the property at a lower price (then contracted with you to buy at) they can come after you for the difference.

Deposits for second time buyers

- The deposit is paid on exchange of contracts.

- Deposits are usually for the amount of 10% of the property purchase price but can be agreed at any amount.

- In a chain of linked transactions, usually only the buyer at the bottom of the chain has to physically pay a deposit (usually 10% of the purchase price).

- Their deposit is ‘passed up the chain’.

- In most cases, the chain relies upon the deposit from the buyer at the bottom being utilised by all.

- This is a widely accepted practice even though the actual deposit amount (being ‘passed up’) is likely to end up being far less than 10% of the value of the property at the top of the chain.

- This means, for example, if you’re the second link in the chain, you will not have to find the cash to put down as a deposit on your purchase because your buyer’s deposit will be ‘passed up the chain’.

- Some sellers (or their solicitors) further up the chain may decide to be difficult and insist on the full 10% deposit being paid.

- This will be a subject for negotiation and you may have to find the funds being requested or walk away from the purchase.

- If upsizing, let your solicitor know (as early as possible) that your buyer’s deposit will not cover a 10% deposit (if requested) on your purchase.

- You should also tell your solicitor whether or not you would be able to raise the necessary funds if required.

Porting your mortgage

Porting a mortgage involves transferring your mortgage from your old property to your new property.

- Each lender has different rules but in theory it is possible to add to your existing mortgage or reduce your mortgage (depending on whether you are up or downsizing).

- If moving home and porting your mortgage before the end of an early repayment penalty period, ask your lender to clarify whether this penalty will still apply.

- If porting and you decide to break the chain (by selling and going into rental for a short period) you may have pay your lender’s early repayment charge.

- Ask your lender (or mortgage advisor) to clarify their rules on this.

- Will they refund this if you take up their mortgage product again when you do buy?

- How long will they keep their mortgage offer open for you?

Read: Simple guide to mortgages when moving home

Reasons why chains fall apart

A generally accepted industry-wise statistic is for 1 in 3 property deals to fall apart after an offer has been accepted.

Here are the top 5 reasons:

- People get cold feet, change their minds & walk away – happens all the time.

- Mortgage finance takes longer to arrange than expected.

- The survey discovers unforeseen & expensive problems with the property.

- Down valuations from mortgage lenders surveyor.

- Seller accepts a higher offer or offer from a buyer in a more proceedable position.

Tips for keeping your chain together

It’s helpful to view the chain as a team sport, a collaborative effort.

Firm but flexible is a winning attitude to adopt.

- Agree an ‘update schedule’ with your conveyancer & your estate agent. Phone, text or email? Once a week or only when something important happens?

- Consider making contact with the other sellers and buyers in the chain to open friendly ‘back channel’ lines of communication.

- Avoid using an overworked conveyancer (as a rule of thumb, the cheaper the service the more overworked they’ll be).

- Avoid online / hybrid estate agents that have a poor reputation for ‘chain management’.

- Favour local full service estate agents that can demonstrate a lower than average fall through rate.

- Sort out your finances & speak to a whole of market mortgage broker as early as possible.

- Investigate chain-break contingency plans before they’re needed.

- Familiarise yourself with the conveyancing process (buying and selling).

- Have to hand all documents you’ll need to produce throughout the conveyancing process.

- Sign (in the correct place) & return all paperwork as quickly as possible – do this by hand, recorded delivery or courier service (avoid second class post) & check a day or two later that the documents have been received.

- Don’t go on holiday.

- Ask your conveyancer & estate agent what holiday they have booked and who will cover in their absence.

How to buy time to link your sale & purchase

As a buyer (or a seller) you can submit (or accept) offers with conditions.

Success will come down to the needs of the party across the negotiating table from you.

If they too need time, are unlikely to get a better offer or simply don’t mind waiting – then flexible deals can be done.

- As a buyer, you can make your offer ‘conditional’ on you finding a buyer for you home.

- As a seller, you can accept an offer ‘conditional’ on you finding a new home.

- All offers should be made ‘subject to survey & contract’ even on a new build.

How to negotiate this in practice

Let’s look at this from the seller’s perspective:

- Be clear to buyers (and your estate agent) that you’ll only accept an offer on the condition you find a suitable property to buy.

- In legal parlance, this is called a ‘Conditional Offer Acceptance’.

- It can be a gentleman’s agreement or you can speak to your solicitor about drafting a clause into your sale contract.

- Make sure you are selling with the support and guidance of an experienced (and trustworthy) local estate agent.

- Ask yourself how much time you’ll need (not an easy thing to accurately estimate). Then try to agree that period with your buyer.

- In return for their patience, take your house off the market for a period of time (e.g. to give them a chance to have a survey done) to give your buyer the confidence to stick with you.

When is this most likely to work?

This often works when you’re selling in a market with low supply and your buyer is desperate to secure your home (because there is nothing else for them to buy).

To get a feel for what this arrangement is like from a buyer’s perspective, read this MoneySavingExpert forum discussion.

What could go wrong with this Arrangement?

Risk #1: You lose your buyer

If you can’t find a home within an acceptable timeframe, your buyer is likely to buy somewhere else.

- For example, if your buyer is in a chain and also selling, they may well be under pressure to exchange contracts with their buyer.

- They won’t be able to do that until you’ve found a home and able to exchange contracts too.

- This will force them to keep looking around for alternative properties.

Risk #2: You experience ‘seller’s remorse’

- If property values rise then by the time you are ready to complete the deal, the price you agreed to sell at may not feel so good.

- However, you can always ask for more money and don’t forget, you may have also already secured your next property at the ‘lower’ rate too.

Another way to buy time

Alternatively, if you’re 100% certain you can find a new home within 6 months, you could lock-in your buyer by exchanging contracts with them but agree a six-month completion clause.

You can add to this clause the option for you to bring completion forward at anytime subject to a timeframe of your choice, such as, 4 weeks notice.

This will put you in quite a decent position:

- When making offers on any new home, you will be seen as a chain-free buyer.

- You probably won’t have to go into rental accommodation.

- You’ll know your sale price so you can now have confidence in your ‘buy price’.

- Your buyer is satisfied because they have the purchase locked in.

- WARNING: This is not risk-free. If you fail to complete at the end of 6 months, there will be penalties for breach of contract.

Again, for negotiations of these types to be successful you need a good team around you.

Choosing your estate agent and conveyancing solicitor on expertise, experience, trust and ethics (over cost) will pay dividends.

Top Tips

During estate agent valuation visits, discuss with each estate agents your plan to make your sale contingent upon finding a new home.

- It’s a good way to find out which of them have the experience and necessary strategy toolbox needed to help you achieve your goal.

- Be wary of any estate agent that offers up nothing other than to insist you sell and move into rental.

- Use our free tool to find the top local agents to help you sell your home.

Top 10 tips: Linking your sale & purchase

#1. Avoid falling victim to deliberate overpricing to win your instruction

- Choosing the estate agent that has promised you the highest sale price is a well-trodden road to moving misery.

- Without accurate and honest pricing advice you will incorrectly calculate your buying budget – that leads to you falling in love with properties you fundamentally can’t afford.

- Zoopla valuations are notoriously inaccurate.

- Historic sold prices are just that – historic! As the saying goes, past performance does not guarantee future results.

- When it comes to selling your house, its value will be determined by its competition in the market (right now).

- A good estate agent will justify their pricing advice (with evidence) and help you position your property in the market to enable you to get the best price the market can bear (within your required timescale).

#2. Avoid the disappointment of falling in love with a property you have little chance of getting – Know the true state of the markets you’ll be buying and selling in

- The best order in which you approach your move depends a lot on whether you’re selling in a hot or a cold market.

- It’s unwise to go on any 2nd viewings if you’re selling in a cold market and yet to put your house on the market.

- Don’t guess at what the market is doing. Know!..Check PropCast™ to find out how ‘hot’ your market is.

#3. Don’t choose your conveyancing solicitor purely on cost

- A conveyancer juggling 120+ transactions at any one time is a fairly common workload in cut-price conveyancing factories – they are likely to be overworked and unable to provide you a personal service.

- You need one that is available to talk to when needed – one that will take the time to understand your personal situation, timeframes & constraints.

- A good conveyancer will be able to exert some control over the pace of your transaction. They can speed things up when needed and also slow things down if you need more time to find your new home.

- If you are using an online/hybrid estate agent do your research before committing to also use their affiliated conveyancing partner.

#4. Work out your finances before you offer on any properties

- Speak to a whole of market mortgage broker as early as possible.

- Rightly or wrongly, many estate agents & sellers will take you more seriously if you have a ‘Agreement In Principle’ (AIP) from your mortgage lender.

- If you’re worried about footprints this may leave on your credit score, you can get a AIP from online broker Trussle that doesn’t involve a credit check.

- Consider the need to fund all or part of your deposit if your seller refuses to accept your buyer’s deposit being ‘passed up’ the chain.

#5. Have your contingency plan ready

- Review the options and take appropriate professional advice.

- Pay attention to unexpected costs like; early redemption penalties (and their dates), arrangement fees, tax implications and increased rates due to changes to the results of lenders’ affordability tests.

#6. Try to avoid long (or dysfunctional) chains

- The longer the chain the greater the risk of it falling apart (or delays happening).

- If you have the luxury to choose whom you buy from or sell to, favour the party that is chain-free or very close to the end of the chain.

- When accepting an offer on your house, make sure your estate agent not only checks the position of your buyer’s sale but also the linked sales below them – a proper ‘old school’ estate agent won’t need asking.

- If your buyer (or seller) is using an online or hybrid estate agent you & your estate agent will have to keep a very close eye on them (especially if they are also using their agent’s associated conveyancing service – their reputation for sales progression is not great).

#7. Minimise abortive costs by staying one step behind your buyer

- It can be a wise move to stay one step behind your buyer just in case they drop out.

- For example, only book your mortgage survey after your buyer has booked theirs.

#8. Choose a ‘no move, no fee’ conveyancing solicitor and instruct them early

- When selling you may need to reduce the time from offer acceptance to being able to exchange contracts.

- You can save almost two weeks by instructing your conveyancer early and have them prepare contract papers before you find a buyer.

#9. Pay attention to your chosen estate agent’s contract tie-in period.

- We like to keep tie-in periods short so we can change agents without delay to keep up marketing momentum.

- A proportion of buyers find your property directly on Rightmove and request to view however, proactive estate agents ‘work’ their buyer database to get additional buyers through your door.

- Different estate agents will get different buyers through your door and some agents are better at getting buyers to view than others.

- No estate agent can sell a home to someone that doesn’t want it. Good estate agents don’t ‘sell houses’ they ‘sell viewings’.

- However a good agent will be able to spot a property that works for a buyer, even if it’s not quite what they had asked for.

- Blindly sticking with an underperforming estate agent that is not getting you a steady stream of viewings will not help you move.

- Avoid estate agents that charge upfront or take their fee regardless of selling your property – are they really motivated to see your sale through to completion?

- Be aware that some agent who charge a fee but allow you to ‘postpone’ it until sale, may do this by tying you into a loan agreement.

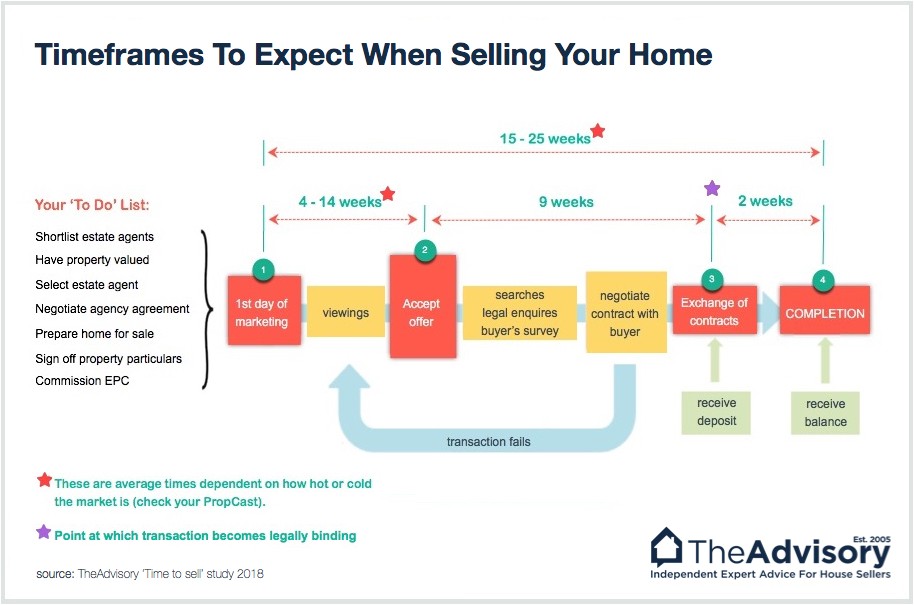

#10. Don’t underestimate how long the process can take.

There are 3 distinct phases when you sell:

Phase 1: On market -> under offer

Phase 2: Under offer -> exchange of contracts

Phase 3: Exchange of contracts -> legal completion

- In a hot market, you should expect to be under offer within 6-weeks.

- In cold markets it’s anyone guess.

How long it takes from offer to exchange of contracts depends on:

- The length of the chain

- The complexity of any problems found along the way

- The proactivity of the estate agents, solicitors, mortgage lenders, surveyors & home movers involved

I hope this graphic helps you visualise the process more easily…

Top Tip: Don’t commit to anything you can’t undo until you exchange contracts because buyers can (and do) pull out at the last minute (see Anneke’s story below).

Anneke emailed me recently:

Hi. My buyer has pulled out today when we were due to exchange tomorrow and complete in 2 weeks time.

If we lose our sale then we will lose the house we are buying.

We have already changed childcare places, work etc and will have to pay solicitor fees etc.

We need to try to complete within the next 3 weeks. Would like to move on 11th August but could stretch to 19th August if needed.

Thanks in advance for your advice.

Buying & selling at the same time (step-by-step)

1. Soul search

- Before anything, make sure you have the answers to the following:

Q1. Do you know where you want to move?

Q2. Do you know what kind of property you’re after?

Q3. Have you separated your housing ‘wants’ from your housing ‘needs’ in readiness for having to compromise

2. Browse portals

- Use Rightmove / Zoopla to get a feel for what’s out there to buy and what properties like yours are being advertised for.

3. Know the true market conditions

4. Shortlist estate agents

- Compare local estate agents based on the facts: how quickly they sell property, how close they come to achieving the asking price and how successful they are.

- Action: Use our free and impartial estate agency comparison tool to get this data for the estate agents in your area.

5. Get savvy about free estate agent valuations

- Understand that ‘deliberate overpricing to win the instruction’ is rife in the estate agency industry.

- Expect to come across at least one snake-oil salesman.

- Keep a lookout for any estate agent brave enough to tell you what you need to hear – Not just what you may want to hear.

- Don’t put stock in pricing advice that isn’t backed up by facts & evidence (or that follows a clearly logical line of thinking).

6. Invite the estate agents round

- Listen to their market appraisals, talk though their proposed marketing strategies and terms of business.

7. Work out your finances

- Speak to a whole of market mortgage broker / independent financial advisor to work out your finances.

- Find suitable mortgage products, access contingency plans and fine tune your purchasing budget.

8. Get an AIP

- Secure an ‘Agreement In Principle’ from your chosen mortgage lender or Trussle (the ‘no credit check required’ option).

9. Instruct your ‘estate agent of choice’

- Notify your first choice estate agent.

- Negotiate short contract tie-in terms.

- Instruct them to prepare draft sales particulars.

- Have them arrange for an EPC to be produced.

10. Instruct a conveyancer

- Choose and instruct a ‘no-move no-fee’ conveyancing solicitor (or licensed conveyancer).

- Quickly complete and return all paperwork provided by them (there will be lots).

11. Check your draft property advert

- Review & approve draft sale particulars from your estate agent.

- Be ready to have your property ‘set live’ in the market.

- But don’t push the button yet…

…Your next step will depend on whether you’re selling in a HOT or COLD market?

Check PropCast™ to find out!

NEXT STEPS – (selling in a COLD market)

12. Go live in the market

- Have your estate agent set your property live in the market.

13. Check you’re live

- Check Rightmove / Zoopla to make sure your property advert is live and all details are as you approved.

14. Go window shopping

- Get out and view property but don’t do any 2nd viewings or make any offers (yet).

15. Make an offer

- Only once you receive an offer on your property (and had the buyer’s position checked by your estate agent) should you make an offer on any new homes.

Pro Tip

Imagine you’ve seen a house you like the look of but you need a full asking price offer on your own home to afford it.

If you receive an offer on yours that’s lower than expected, don’t immediately discount it.

Take a moment to work out what your max offer would now be (for the new home) and go make it.

Definitely give this a go if the property you like the look of is also selling in a cold market.

You never know, you may be able to secure the house at a better price than expected. The seller may just have been about to reduce their asking price!

NEXT STEPS – (selling in a HOT market & buying in a COLD market)

12. Go window shopping

- Get out there home hunting in earnest (first viewings only).

13. Go live in the market

- Once you’ve a shortlist of homes you wish to view a second time &/or make an offer on, have your estate agent set your property live in the market.

14. Make an offer!

Is pretty safe to do this because in a hot market you should be under offer within 4 weeks (if not less) as long as:

- You’ve chosen a decent estate agent

- Your house is saleable & priced competitively

NEXT STEPS – (selling in a HOT market & buying in a HOT market)

12. Go live in the market

- Have your estate agent set your property live in the market.

13. Go shopping with intent

- View shortlist properties and make offers.

14. Be proactive

- Reduce your price if no offers come in on your property within the first 2 weeks.

15. And if all else fails…

- Discover the best way to sell your house quickly and avoid scams – AVOID SCAMS

Compare your local estate agents

Find the best high-street estate agents, based on an impartial data-driven analysis of their past performance.

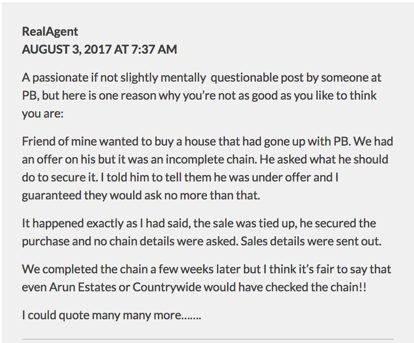

Making an offer on a house before selling yours

This often (but not always) ends in disappointment.

In fact (and this is especially true) if you’re not yet on the market yourself, you may not even get to first base because many estate agents (and house sellers) won’t even let you in for a viewing (let alone make an offer).

Even when you’re on the market, few house sellers will take their property off the market for a buyer that is ‘for sale’ but not yet ‘under offer’.

That said…

…If you don’t know how much the property you want to buy can be purchased for, you don’t know how much you can afford to sell for.

So make an offer because you never know what sort of reception you’ll get (just don’t be surprised if it’s frosty).

When to consider making an offer

Take the test:

- Are you sure your property will sell quickly? [Check PropCast to find out] & [Why you should avoid cheap online estate agents]

- Are you sure you’ve received accurate pricing advice from your estate agent? [Read this]

- Are you pre-approved for a suitable mortgage?

- Are you sure you can handle the disappointment of losing out on a few homes?

If you answered, ‘yes’ to all the above, there’s no harm making an offer.

Getting your offer accepted

Know this:

- Estate agents have a legal requirement to pass on all offers.

- You won’t know how the estate agent and their vendor client will react until you try.

Your best chance of having your offer accepted is when the property is in a cold market and you’re the only buyer to show interest.

However, in both hot & cold markets, if you’re up against a competing buyer(s) then a number of other factors come into play:

#1. Are you PTS (property to sell) or are you PTSOM (property to sell on market)?

- As discussed earlier, the latter puts you in a better position – but is it better than your competitor(s)?

- Undoubtedly, if you’re up against another buyer in a better position, you’ll have to out-bid them considerably to be in with chance.

- Whether that works will depends on the seller’s priorities.

- Are they more motivated by time or money?

- If it’s money, you could be in with a chance.

#2. What type of agent is selling the property you want to buy?

Good estate agents:

- A really good full service high street agent will access your position (as a buyer) and grade you accordingly.

- They will compare you to any other interested parties and advise their vendor client appropriately.

- If there are other interested parties or the property has only recently come to market, you can expect your offer to be rejected.

- In this scenario, the best you can expect is a gentlemen’s agreement in principle to a price the vendor would be willing to accept, IF & WHEN your property sells.

- It won’t be binding and don’t expect the vendor to take their property off the market in the meantime.

- Alternatively, if there are no competing buyers and you’re moving locally, a really good agent will recognise whether your property should sell quickly and may well advise their client to consider your offer more favourably.

- In this scenario there are benefits to instructing this same agent to sell your home.

Bad estate agents:

- If the selling agent is not particularly skilled or ethical (i.e. not really looking out for their client’s best interests) and your offer is the first or the highest, they may pressure their client into taking the property off the market.

- That could give you a chance of success (at the seller’s expense).

Cheap online / hybrid estate agents:

- It’s unclear how rigorous these nationwide online / hybrid estate agents are with regard to vetting buyers by checking their chain &/or ability to proceed.

- Currently, it not unreasonable to argue that targeting sellers using these budget agents could increase your chances of having an offer accepted.

Contingencies & how to break the housing chain

Moving home is stressful at the best of times.

Even more so when your moving plans are reliant on the actions of a bunch of other people you’ve never met (or are ever likely to meet).

Property chains = More drama than an episode of East Enders

Some home movers try to avoid them (or minimise their length) by:

- Selling up and going into rental.

- Buying outright and then selling at a later date.

- Taking on additional debt as a way to secure a home without having to link their sale & purchase.

Others don’t mind (or have no choice) being part of a chain only to find their chain breaking around them:

- Suddenly you can find yourself in a situation where to secure the home you’ve fallen in love with, you’re forced to exchange on (or exchange & complete on) its purchase or risk loosing it.

- Anything can happen (and usually does) so it’s best to be prepared for all eventualities.

Can I buy another house before i sell mine?

Yes you can.

But for most people that requires taking on additional debt.

And you know what debt means…

DEBT = RISK

The risks of buying before selling

If you’ve done your sums, taken accurate advice and your property sells as expected, your risk is managed.

However, we’ve lost count of how many house sellers have had to get in touch, precisely because their sale has NOT gone according to plan.

Before you even consider buying before selling, a wise seller is in no doubt about this:

There is a dysfunctional relationship that exists between the estate agency industry and the public.

…It makes getting truthful and accurate advice (about pricing and the state of the market) harder than you might think.

Unexpected costs to consider

- Are you financially able to cope with the possibility of having to pay off two mortgages until your house sells?

- Are you financially able to cope with being liable for Council Tax & buildings insurance on both properties?

- Do you have the ready cash to pay for all your potential associated buying costs; mortgage fees, survey costs, removal fees and your solicitor’s bill for acting on your purchase?

- Do you have funds available to cover your Stamp Duty liability and the refundable 3% SDLT surcharge now levied on the purchase of second properties?

- Have you considered how to fund the 10% purchase deposit required on exchange of contracts if it’s now not coming from the buyer of your property?

Key Takeaways

- Know that ‘deliberate overpricing to win the instruction’ is rife in the estate agency industry.

- If you’re basing your purchase offers & sums off the back of an unachievable sale price – you’ve lost before you’ve even begun.

- Don’t take an estate agent’s word that your property should sell quickly and that the market is buoyant.

- Check their claims by checking PropCast™ to find out the true state of your local sales market.

- If it’s ‘cold’ (i.e. house are not selling quickly or easily), think twice about taking on a bridging loan or extending your debt burden in anyway.

How to ‘break the chain’ and buy that house!

Before you make any offers or do any serious house hunting, it’s essential to have already:

- Worked through your finances to clarify your current financial position & purchasing budget.

- Assess the risk and affordability of the available funding options to pinpointed ones that will work for you.

- Be aware of the timescales involved in setting up each of these funding options.

To get you orientated, below are the most common funding options home-movers use to break the chain:

Option #1: Extend your existing mortgage (or remortgage)

If you have enough equity in the property you’re selling, you can release cash to fund a deposit for a new mortgage / new home.

There are two main ways to do this:

- Extending your existing mortgage (with current lender)

- Remortgaging (through a different lender)

Depending on your personal circumstances, you can then:

- Rent out your old home to cover the mortgage payments on the existing mortgage – this is know as Let To Buy and you will need your lender’s permission.

- Do the same as above but then remortgage onto a Buy To Let product with another lender – make sure you check early repayment penalties with your existing lender.

- Leave your existing home empty and pay two mortgages while you wait for it to sell – check your new mortgage allows for you to make a big extra repayment (without penalty) once the money from your sale comes in.

Essential: Speak to a whole of market mortgage broker to properly access your personal finances and the suitability of these options.

Make sure you’re crystal clear on all the costs involved (and how you’ll pay them) such as:

- Arrangement fees

- Valuations fees

- Potential early redemption penalties

- Refundable 3% SDLT surcharge on additional property purchases

Option #2: Bridging loans

- A bridging loan (or bridging finance) is a short-term, interest only repayment loan secured against residential, commercial property or land.

- Downsizers that have significant equity in their existing property often successfully use these types of loans.

- However, the risks cannot be underestimated.

- If you take on a bridging loan and are unable to sell your property as planned, the monthly interest payments can quickly become crippling.

Q. How much can I borrow?

- Potentially you could borrow anywhere from £10,000 – £20,000,000.

Q. Can I get 100% loan to value bridging finance?

- 75%-80% LTV for residential property is the industry norm.

- 100% LTV is possible if you are able to provide extra security for the loan (other assets to secure the loan against).

Q. How long can I borrow the money for?

- Most lenders cap this at 12-18 months.

Q. How quickly can a loan be arranged?

- 14 days is the industry norm

Q. What are the typical costs?

- £1,000 (Admin fee)

- 1% (Arrangement fee)

- 75%-1.5% (Monthly interest payment)

- 1% (Exit fee)

Note: Many lenders will allow for the monthly interest payments to be ‘rolled up’ so you pay them off as a lump sum when you redeem the loan.

How to ‘break the chain’ & sell your house!

The phone rings, it’s your solicitor…

…You note a nervous tone in their voice:

“Mrs Miggins, I regret to inform you that the buyer’s solicitor has just been in touch – their client has backed out of the purchase.”

Disaster!

Shredding of clothes, crying in the corner & thoughts of hiring a hit man off Gumtree ensues.

After that, house sellers tend to turn to the following options:

Option #1: Cash House Buying Companies

Look on Google and you’ll see 100’s of companies out there claiming to be able to buy your home, for cash, within 7-14 days.

Absolute hogwash.

There are maybe 5 companies that can do this (and only 1 or two you can trust), the rest are to be avoided like the plague.

Insider Tip – This industry is NOT regulated; steer clear of any company that claims to be ‘regulated’.

Q. What do ‘Quick Sale’ companies pay?

Here’s the truth:

- No company can pay more than 80-82% (85% in exceptional circumstances) of the price they could sell your property (relatively quickly for) on the open market.

- The industry average is to pay 80% of a RICS valuation.

- A RICS valuation is going to be lower than the ‘promised’ sale price told to you by estate agents.

Q. Does anyone really use these companies?

- When it comes to providing a ‘chain-break’ service, it’s really only down-sizers with tons of equity that can afford to accept an offer at 80-82% of market value.

Q. Will they really buy ‘any’ property?

- Most companies buy property between £80k-£250k.

- A few will buy property up to £500k.

- Virtually none of these companies will buy property over £500k (except in exceptional circumstances).

Q. What are the scams I need to be aware of?

- These companies know they’re dealing with house sellers for whom the clock is ticking.

- The big complaint we hear is of companies promising one price but reducing that price significantly on the day contracts are meant to exchange.

- This leaves vulnerable house sellers in an awful ‘take it or leave it’ situation.

Bottom Line

- There are a handful (and it’s a small hand at that) of reputable companies out there.

- The near instant liquidity they provide to the property market is a valuable and necessary service (for a minority of house sellers that have no other options).

Get free help: Find reputable ‘we buy any home’ companies

Option #2: Quick Sale Estate Agents

As mentioned above, genuine cash house buying companies can only pay roughly 80-82% of market value.

But spend enough time on Google and you won’t fail to find companies that claim to pay 90-100% of market value.

When you speak to them they may refer to this as their ‘slower option’, their ‘intelligent sale option’, an ‘investor sale’ or an ‘assisted sale’.

So what’s really going on?..

The claim vs. The reality

The ‘claim’

- Quick Sale Estate Agents claim to have “a database of cash investors all willing to pay close to market value”.

- They claim to be able to secure you an ‘investor buyer’ at 90-100% of market value within 14-28 days.

- Some even claim to ‘guarantee’ this outcome.

The ‘reality’

- To guarantee a sale at this level and within this timeframe is misleading.

- The claims are unsubstantiated.

- They do not yet have a buyer for your house & there is no way they can ‘guarantee’ to find one.

What house sellers tell us?

An alarming number of house sellers (that have taken these claims at face value) have contacted us once they realised their homes’ were not going to be purchased as promised.

They tell us:

- They feel naive having been taken advantage of.

- They feel mislead.

- They are shocked to find their properties being advertised on Rightmove & Zoopla at lower than acceptable prices.

As John Cardwell put it to me in an email:

The way they explained it to me was they would sell it within the time specified to one of their investors and I would get £85000. I’ve realised it was just a load of lies to be honest

And more recently, here’s the conclusion Stewart Savage came to:

Regarding XXXXXXXXX, they have confirmed that the 95% route amounts to just marketing the prop on Rightmove and frankly I cannot see this having any advantage over a local estate agent.

In fact it seems even less effective than using local estate agents. Consequently I will not be going down that route

Finally, here’s what Christine had to say:

I realised XXXXXXXXXX were lying to me when after the first week the investors they promised didn’t appear.

By the third week they had reduced the house price by £60k.

No offers and no viewings. I have cancelled the contract given up on them very very disappointed.

…Scam!

Our conclusions

Given companies claiming to pay 90-100% of market value will advertise your property on Rightmove / Zoopla, it’s reasonable to question whether the claimed ‘database of cash investor buyers’ exists in the first place.

Surely if such a database did exist, all a company would need to do is take some photos / details of your property and then email them out to this database?

Publicly advertising your property should NOT be required.

As such, our conclusion is this:

- A company’s ‘offer to pay 90-100% of market value’ is NOT an offer to buy your house.

- It’s an offer to sell your house…

- Also know as, acting as an estate agent.

- Of the quick sale estate agents we’ve been made aware of, the feedback received leads us to believe they do nothing more than provide you with a Rightmove / Zoopla advert (at a low asking price).

How to stay safe

Alarm bells should ring if anyone asks you to sign any sort of ‘tie in’, ‘option’ or ‘agency’ contract.

Also, avoid anyone asking you to sign a RX1 form.

No matter how professional they sound, or how sure they say they are in being able to find you a buyer…

…If they are also asking you to sign any of the above – WALK AWAY! They can’t be trusted.

Also, don’t put too much stock in membership of NAPB or The Property Ombudsman.

This is no guarantee a company is reputable.

Both are fairly ineffectual organisations when it comes to protecting vulnerable house sellers in need of a quick sale.

They are better than nothing but please don’t drop your guard.

Option #3: Auction

There is a perception that selling a house at auction is a ‘sure fire’ way to get it sold.

This is not so.

Properties that sell well at auction tend to have:

- Development potential

- Refurbishment potential

- Some other opportunity to add significant value or generate income

Pro Tip: If yours is simply a reasonable/good home, in reasonable/good condition – going to auction is likely to do your sale more harm than good.

Q. Why more harm than good?

If you are selling via and estate agent and then you also put your home into auction, you’ll end up with two listings on Rightmove.

They will have different prices.

The auction listing will tend to be a ‘guide price’ and will be lower than your estate agency listing.

Same property but 2 different prices = Confused buyers

Buyers are a skittish bunch; they do not like to feel confused.

It must be said that this property was not right for auction – should never have been submitted for auction – it failed to sell.

Instead, the seller of the above property found interest in their home totally dried up until after the property auction (and the auction listing was removed from Rightmove).

Even then, interest was muted because many of the buyers in the market had seen the auction listing (i.e. seen the property advertised for £150,000) and now found the current £179,950 asking price off-putting.

Bottom Line

- Going down the auction route needs carful consideration and good advice.

- It’s a mistake to assume buyers will understand why a property is being advertised at two different prices.

- You will not fail to find at least one auctioneer happy to put an inappropriate property into auction and take a non-refundable marketing fee from you.

Option #4: Make changes to your current sale

In our experience, the best way to get a fresh wave of buyers through the door is to either:

- Reduce the asking price

- Change estate agent

- Bring another estate agent on-board alongside existing estate agent

- Combination of all the above

4.i. Reducing the asking price

- Price tweaking can have immediate impact but needs careful consideration.

- They are not guaranteed to work.

- The decisions should only be taken after you’ve had a frank discussion with your estate agent about how your property ‘sits in the market’ against it’s competing properties.

- If you do do it, it’s wise to do it once, don’t keep ‘shaving’ money off the price.

4.ii. Change estate agent

- Put your property on the market with a quality estate agent and the first thing they will do is hit the phones and ‘sell the viewing’ to buyers on their database looking in your price bracket.

- After that, most of the additional interest in your property will come directly from enquires generated by your Rightmove advert.

- As such, most estate agents are most potent at the beginning of the marketing period.

- If you feel your estate agent has stopped pushing your property and ‘lost interest’ to a certain extent – change agent…Don’t hesitate!

Top Tip: If you need to find a buyer that can complete quickly, you need to find someone that’s ‘chain-free’.

Estate agents that do ‘sales & lettings’ are best positioned to put your property in front of local property investors that are often able to arrange finance quickly or pay cash.

4.iii. Bring in a second estate agent (i.e. go ‘multi’)

- ‘Multi Agency’ gets bad press and is very misunderstood by the public (and the media).

- Mostly because estate agents have been knocking it for years.

- That makes sense – no estate agent really wants to share an instruction and then have only 50% chance of securing a fee.

- They want the instruction all to themselves so they retain 100% chance of securing a fee.

- Never the less, what’s good for the goose is not necessarily good for the gander.

Multi Agency = The Professional’s Choice

- There isn’t a single Corporate Asset Management firm or Part Exchange provider that doesn’t virtually always engage 2 estate agents when selling a residential property.

- It’s certainly how we sell property and firmly believe it’s the corner stone of why we achieve superior results compared to the general public.

Benefits of ‘multi agency‘

- Done right, this can increase the effectiveness of the estate agents.

- It makes them work harder and prioritise your sale over their other clients.

- It will get more buyers through your door, faster.

The wrong way to do it…

We see this mistake a lot.

The house seller brings in a second agent but structures things so the agents split the fee.

Regardless of which one finds the buyer, they both get paid.

Splitting the fee halves the effort of each agent as each one sits back leaving the other to do the work.

End result?…No sale.

The right way to do it…

If you are going to bring in a second estate agent, the agents must we working in competition with one another on a winner takes all basis.

With the right agents selected, this can work a treat and totally re-boot your sale.

Yes, ‘multi agency’ fees are higher than ‘sole agency’ fees but if you’re using ‘no sale no fee’ estate agents, this fee is only paid if you get the result you’re after.

In the grand scheme of things, if this allows you to secure your new home, it’s a small price to pay.

Option #5: Negotiate price reduction along the chain

Let us say your chain is about to fall apart because your buyer’s survey has raised structural problems.

Your buyer is still willing to go ahead but only at a reduced price…

…That new price will prevent you from being able to afford your onward purchase.

Trying to find another buyer is probably a waste of time.

They’re likely to get a survey – that survey is likely to highlight exactly the same problem.

So what do you do?

This is where you’ll be grateful you didn’t choose to go with a national online / hybrid call-centre estate agent.

It’s at times like this that an experienced ‘no sale no fee’ estate agent really comes into their own.

- They don’t get paid unless you move so they are invested in finding solutions to these sorts of problems.

- It takes skill, tenacity and a delicate touch but it can be done.

- It is possible for your estate agent to negotiate a price reduction all the way up the chain in order to keep everyone moving.

- The only person to loose out financially is the one at the top of the chain.

- It absolutely is not unheard of for them to see the merit in accepting a reduced price in order to save the chain falling apart and everyone having to start over.

BONUS Option: Part-Exchange with Home Builder

This is not really a chain break contingency option, more a ‘chain avoidance’ option.

House builders big and small offer, ‘part-exchange’.

Subject to meeting their individual criteria, the house builder will buy your existing home so you can buy one of their new build properties.

The major players

- Taylor Wimpey

- Barratt Homes

- David Wilson Homes

- Bellway Homes

- Linden Homes

- Charles Church

- Crest Nicholson

- McCarthy & Stone

The benefits of part exchange

- No viewings

- No estate agent fees

- No uncertainty

- No chain – You get to opt out entirely

Also, most house builders allow you to continue living in your existing home until your new one is finished being built and ready to move into.

If trading up, typically you have to purchase a property worth 30% more than your current property.

If trading down, it’s likely they are using a third party to fund your property, but they should be upfront about it and typically monitor these company carefully to ensure they are working ethically.

Find the best estate agent for your sale

Find the best estate agents in your local area and review how successful they are at selling homes like yours.

Related guides

- How to sell your house

- Should you sell or rent?

- When is the best time to sell?

- How long should it take to sell?

- How much should selling cost?

- How to prepare your house for sale

- Capital gains tax when selling a house

Related guides

Did you

know?..

The hotter your market

the easier your sale...